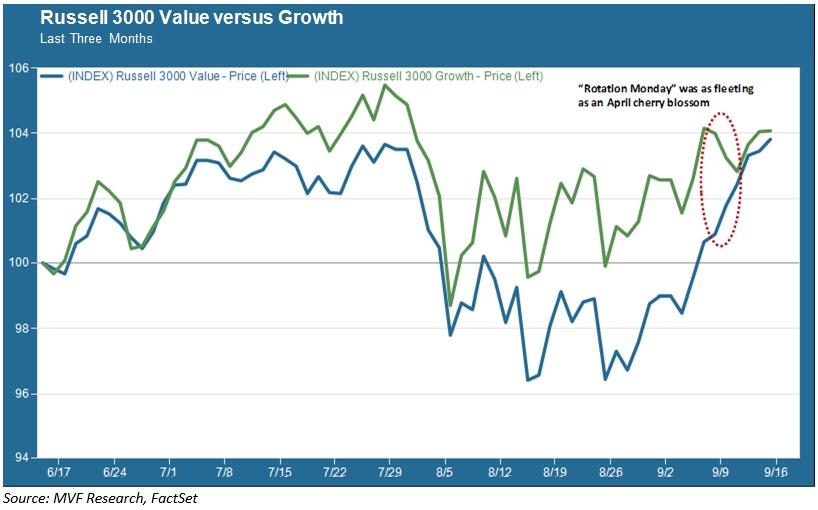

If you weren’t listening to the financial chatter this week then you probably missed the Great Rotation. But if for whatever reason you happened to tune into CNBC or Bloomberg News sometime late Monday afternoon then you couldn’t have missed it. Every “factor” and “smart beta” analyst on the planet seemed to weigh in on the big moves in the market that day. What big moves, you might have asked? Good question, given that the S&P 500 closed at 2978.43, just one-one hundredth of a percent lower than the 2978.71 close of the previous Friday. Behold, though, for what lay below that placid surface was a double helping of toil and trouble: a plunge in high-growth momentum stocks while at the same time unsexy value stocks soared. The chart below shows Rotation Monday, with the Russell 3000 Growth index (in green) falling by about the same amount as that by which the Russell 3000 Value index (in blue) rose.

And then it was over. By Tuesday growth stocks were back in favor, and both style classes continued to post reasonably modest gains for the rest of the week. The debate continues, though. Value stocks have been out of favor for an incredibly long time, and the laws of mean reversion would suggest that at some point all the money crowded into those pricey growth names moves out and gives us an actual factor rotation worthy of its name. The problem is that there is nothing in particular to suggest that now is precisely that time.

The Late, Great Value Effect

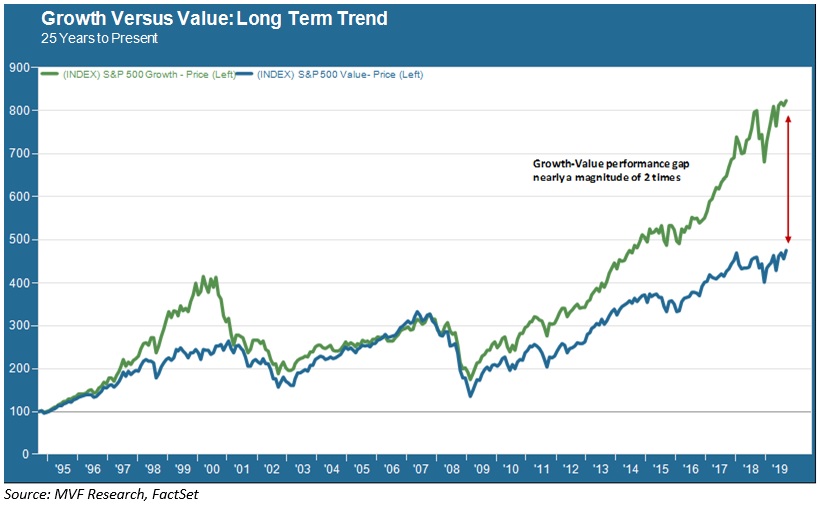

The plight of value stocks remains one of the more enduring puzzles of finance. “Over the long term, value will outperform growth” is one of those old chestnuts learned by everyone who enters the guild of financial analysts. That was true for much of the last century-plus of equity market history, but it has not been true for a very long time. In the chart below we see the performance of value versus growth (this time using the S&P 500 value and growth indexes) over the past 25 years. The outperformance of growth over this very long period is eye-catching.

What caused this apparent disappearance of the value effect? There are a handful of plausible-sounding explanations. Other than the tech bubble of the late 1990s, the sustained outperformance of growth has taken place largely in the second decade of the 21st century. Two structural characteristics of these years have been low interest rates and falling energy prices. These factors, in turn, have dampened enthusiasm for financial stocks and energy stocks – which also happen to occupy quite a bit of space in most value indexes. At the same time, technology companies (typically a mainstay of growth indexes) have steadily encroached on the territory of other industry sectors as an ever-greater swath of the economy has gone digital. Moreover, growth-oriented companies in general tend to benefit from persistently low interest rates as it makes it cheaper to fund their capital spending projects with low-cost debt.

Meaning and Mean Reversion

All that is well and good as far as explanations go, but what about mean reversion? Surely that other time-tested investment adage still holds true, the one about what goes up must also go down…right? After all, that sustained outperformance comes with a hefty price tag. The trailing twelve months P/E ratio for the S&P 500 Growth index is currently 24.2 times, while the S&P 500 Value index is a relative bargain at 15.3 times. It’s not surprising, then, that a sudden move like this week’s Rotation Monday would be setting off bells on the screens of asset allocators pondering tactical rotation decisions.

There’s not much one can read into the short period after Monday’s close, except to say that nothing in the way of sustained outperformance for value stocks has taken place since. Nor have the overall macro factors changed much. Whatever it was that was working for growth before would still seem to be working today – low interest rates, for one, are not going anywhere even if the 10-year Treasury yield is higher today than it was a week ago and the 30-year is back above 2 percent. Mini-rotations like Monday are to be expected from time to time – and how nice it was that the value stock buying frenzy saved us from having a big drop in the overall market to start the week. But it may be some time yet before the rotation plants firmer roots and returns value investing to its erstwhile glory days.