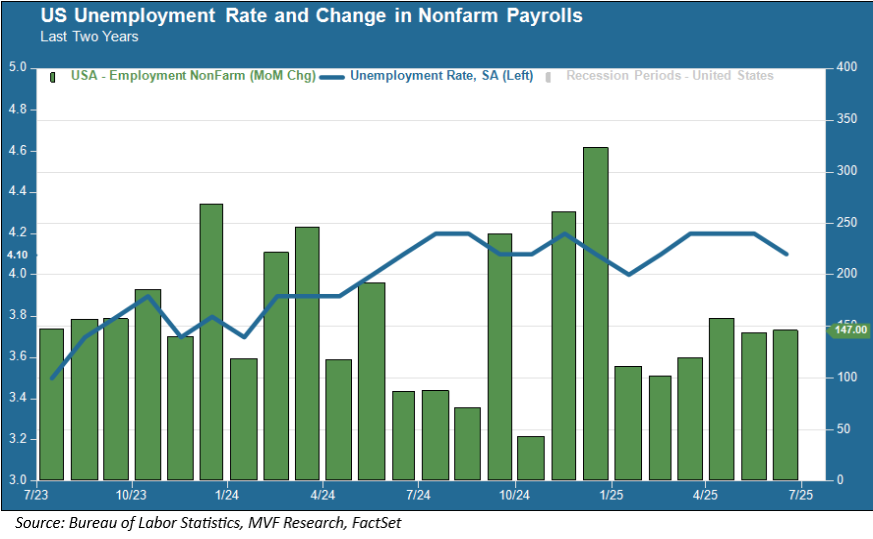

The third quarter of 2025 is underway. So far, at least, it has seamlessly picked up the baton from Q2: quiet headline data that fails to make an impact on the Alfred E. Neuman (what, me worry?) market that we talked about in our commentary last week. Today, that headline data point is the monthly jobs report from the Bureau of Labor Statistics. Now, we might have expected this report to land on our desks with all the angst of an awkward middle schooler. Earlier this week a different jobs report, the ADP Employment Survey, showed a net loss in hiring for June, with payrolls shrinking by 33,000 souls. Would the BLS report, where economists expected to see payroll gains of 117,500 and a slight uptick in unemployment to 4.3 percent, also deliver a surprise to the downside?

Nope. The Bureau reported a 147,000 increase in nonfarm payrolls and a small decrease in the unemployment rate to 4.1 percent. Given where we are in the economic cycle, that’s about as tidy a labor market snapshot as one could hope for.

All Roads Lead to Healthcare

Around a third of those nonfarm payroll gains are attributable to one single industry: healthcare. This is consistent with the trend thus far this year; in fact, healthcare is the nation’s top employer, growing from nine percent of the total workforce in 2000 to around 13 percent today. Along with the increase in bodies employed as healthcare workers, their salaries have been rising as well. On average since 1980, wages in healthcare have grown at nearly twice the rate of pay in the rest of the economy. And, in what will come as a surprise to absolutely nobody, American households now spend more annually on health-related expenses than they do on groceries or housing.

So it would not be inaccurate to say that as healthcare goes, so goes the US economy. Which brings us to the other bit of news this week: the tax cut and spending bill that is working its way through the House and has a very high likelihood of arriving on the president’s desk for signing roughly sometime not too long after this commentary appears in your inbox. There is plenty to be concerned about in this bill (to put it mildly), but let’s focus on the bits that pertain to healthcare.

Not Going to Age Well

The American population, like those in most other countries, is ageing. As the country gets older, access to affordable healthcare becomes more important. The bill that is about to become law, however, is expected to make steep cuts to Medicaid and other healthcare subsidies to the tune of around one trillion dollars over the next decade, resulting in somewhere between 12 to 17 million Americans losing their health insurance. Medicaid, which primarily serves lower-income households, makes up around one sixth of total healthcare spending. The spending cuts are likely to weigh heavily on the operations of clinics, hospitals and other providers of services to low-income communities. We expect this will show up, sooner or later, in the jobs numbers that healthcare’s fortunes have kept buoyant for so long. Unfortunately, it is also likely to show up in the statistics showing a country getting sicker as it ages.

The US economy has a history of being remarkably flexible in adapting to changing circumstances. When manufacturing jobs left the country in the 1990s and early 2000s, the growing healthcare industry was able to cushion the blow for anyone willing to trade in production-line skills for training in nursing, lab technician work and the like. We may be approaching another one of those junctures where new doors will have to open as others close. What lies on the other side of those doors, though, remains to be seen.