Sometimes the wry humor just writes itself. This week saw the House pass a tax bill going by the name “one big beautiful bill” – or “Triple-B”, as some of the Republican House staffers would refer to it in their back-and-forth messaging during the sausage-making process. Bond investors, always happy to latch onto a joke at some else’s expense, piled onto the Triple-B moniker – BBB, of course, is the lowest rung on the investment grade credit scale before descending into the funhouse of junk bond ratings. As in: that’s where American government debt – the world’s long-enduring proxy for a risk-free rate –could eventually be headed if this bill makes its way into law. Passage is not yet a foregone conclusion, as the bill will have to make its way past some potentially ornery opposition in the Senate before it gets to the president’s desk. But given the current state of Republican politics and the administration’s overweening desire to see this thing to the finish line, it’s a pretty good bet that something very close to the current plan will manage to arrive at 1600 Pennsylvania before too long.

20-year Bond? Anyone?

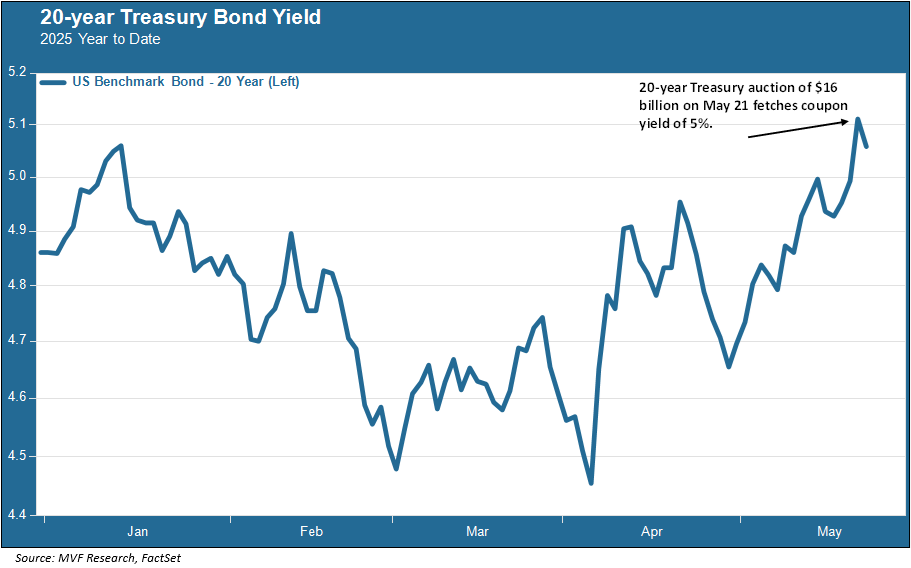

The latest opposing salvo from the bond market came on Wednesday this week when a $16 billion auction of 20-year Treasury bonds, in the face of weak demand, went out at a yield of 5 percent. The 20-year maturity is a relatively recent addition to the Treasury stable, introduced in 2020, and this week’s auction represented the highest yield for a new offering.

On the same day as the tepid 20-year offering, yields on the bellwether 30-year bond reached their highest level since 2007. At the same time the dollar, which had been finding some strength in recent days thanks mostly to the apparent de-escalation of the trade war, resumed falling, and conditions started to look a lot like those dark days in the immediate wake of the April 2 tariff announcements (as we are writing this on Friday morning, those kinder and gentler trade headlines of late are coming under renewed fire with a new announcement by the administration of 50 percent tariffs on products from the EU and 25 percent tariffs specifically on any Apple iPhones not made in the US. Ugh.).

Gently, then Suddenly

To be clear, the bond market’s reaction this week has been more of a gentle nudge than a violent shove. Yields on intermediate and long-dated maturities have settled back down a bit from where they were in the immediate aftermath of the 20-year auction on Wednesday. There may be some hedging going on as investors speculate on whether there might be more meaningful pushback from the Senate before the Triple-B tax act gets written into law (a sentiment we do not share, given that the main force likely to push up debt and attendant deficits will come from the extension of the 2017 tax cuts, and we see little to no likelihood of those being pulled out or tampered down by anyone in this Congress). In general, movements in the bond market tend to be more measured and gradual than the more volatile day-to-day lurches we often see in the stock market.

Our concern, though, is that at a certain tipping point things can start to unravel quickly. What might that tipping point be? Some observers think that if the 10-year breaches five percent then we could see a much more pronounced pullback, along with plummeting demand for new Treasury issues making this week’s 20-year auction seem quaint by comparison. We’re not convinced that five percent – which is only 0.5 percent away from where yields are today – would be that dramatic of a trigger. We agree, though, that there is an event horizon out there beyond which we have no desire to travel.

That famous line from Ernest Hemingway’s “The Sun Also Rises” comes to mind, when a character named Bill asks another, Mike, how he went bankrupt. Mike replies “gradually, then suddenly.” We hope that our policymakers will heed the bond market’s gentle nudges and take appropriate actions before they turn into shoves of a more sudden and unpleasant nature. Meanwhile, our bond market mantra is simple: keep your credit quality high, diversify where possible, and think shorter duration.