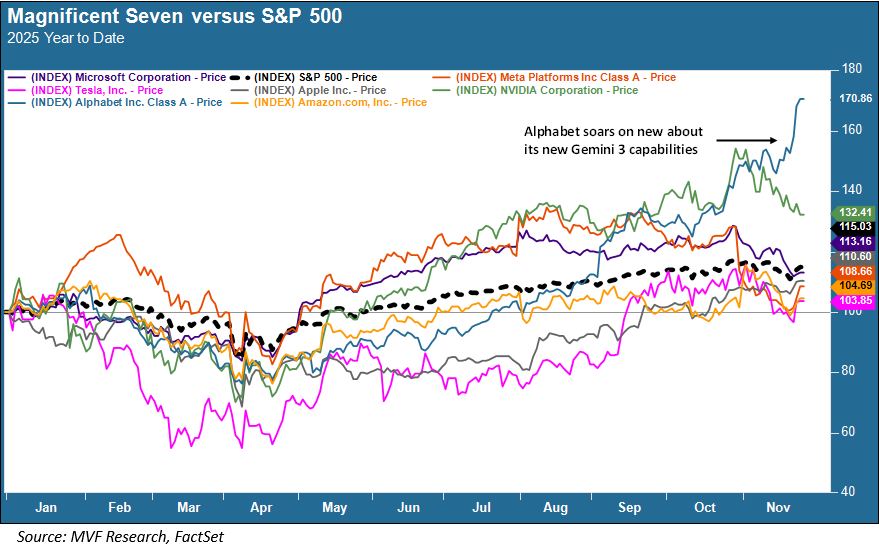

And then there were two. Oh how ye have fallen, mighty Magnificent Seven of yore. Today, just two of these august mega-cap companies, so crucial to the long-running saga of AI dominance over the US stock market, are outpacing the S&P 500 in price gains for the year. The fortunate two are Nvidia and, now in the group’s pole position, Alphabet. And herein lies a lesson about how the AI story, through all its strange twists and turns over the past three years, keeps coming out ahead.

The Deep Seek Effect, Reborn

Earlier this year, the AI world was shaken by the sudden appearance of Deep Seek, an offering from China that appeared to do just about everything its US competitors could, only at a much cheaper price. What if, the pundits asked, all those hundreds of billions of dollars being poured into AI infrastructure projects here at home turned out to be wildly overdone? For a couple weeks, the Mag Seven and others in their orbit took a big hit. Then, as tends to be the case, investors did a rethink and decided that there was plenty of room for both the Deep Seeks of the world and the cascade of dollars building out data centers and large language models and all the rest of it on our shores.

This week, the financial chattering class has been all abuzz about what is being called “another Deep Seek moment.” Deep Seek is apparently the AI equivalent of Watergate – the iconic event whose name one attaches to every subsequent development of major note in the space, be that leaps forward in AI technology or political scandals. In any case, this week’s Deep Seek moment is called Gemini 3, the newest addition to the world’s stable of AI large language modules (LLMs), this one courtesy of Alphabet, the parent company of Google. Gemini 3, according to experts familiar with the milestones by which LLMs are evaluated, has demonstrated superior capabilities to OpenAI’s ChatGPT, up to now the US poster child for the wonders of generative AI.

TPUs Ratchet Up the Tensors

Gemini 3 is powered by internally developed (at Alphabet) chips called Tensor Processing Units (TPUs), which are different from the Graphic Processing Units (GPUs) dominated in the AI space by Nvidia. Hence, in the chart above, the stark contrast between the recent share price trends of Alphabet (way up) and Nvidia (way down). TPUs appear to be a cheaper alternative to Nvidia’s GPUs (here again the “cheaper alternative” refrain from Deep Seek), and Alphabet has been approaching other LLM developers, such as Anthropic, in what could be a direct threat to a portion of Nvidia’s revenues (Alphabet itself is also a customer of Nvidia, illustrating the tangled web of customers, partners, investors, friends and enemies in this industry).

Time For Another Rethink?

The story, of course, is never that simple and is likely to evolve and shape-shift yet again. Alphabet’s TPUs were developed largely with that company’s products in mind, and there are probably serious limits to how fungible they will turn out to be in adapting to the products of other AI service providers. Nvidia’s chips have an edge here in that its software platform is designed for a broader spectrum of applications. Recent comments from spokespersons at Nvidia suggest a lack of undue concern over there, whether due to confidence in their chips being one or two generations ahead of the pack or simply a show of bravado. One way or another, though, there are likely to be many more chapters to the AI story, and plenty of “Deep Seek moments” in store for the months ahead.

Meanwhile, it is time to take a short break from all things global markets and enjoy the company of our friends and loved ones as we gather for Thanksgiving. May yours be full of good cheer and good health.