Negative interest rates – or “Wonderland” as we have come to call them – up to now have been a distinctly European fashion. The common currency Eurozone has them. So do non-currency zone neighbors Switzerland and Denmark. Nowhere else did they exist – until now. The Bank of Japan surprised markets on Friday with an announcement that it plans to lower its key interest rate to -1.0 percent. BoJ head Haruhiko Kuroda’s decision to “go European” reflects a country determined to battle its way out of near-deflation, but with a limited set of weapons in its policymaking arsenal. The most recent batch of headline statistics – also released yesterday and today – have little to show for all the slings and arrows of Abenomics over the past four years. Without meaningful structural reform to accompany its monetary policy, Japan will find it difficult to regenerate sustainable growth.

Three Tiers of Confusion

Japan’s new negative rate regime is somewhat confusing in its details. It appears that Japanese rates can be somewhat like Schrödinger’s cat – both positive and negative at the same time. Specifically, the negative rate does not apply to the ¥250-odd trillion of existing bank reserves. The majority of these will now be classified as “basic balance” reserves and they will continue to earn interest at the prevailing 0.1 percent rate. Then there will be a second, smaller tier of reserves that earn zero percent. Finally, the negative rates announced today will pertain only to a third tier of “policy rate balance” reserves – essentially, any excess bank reserves generated by future quantitative easing activity. The practical impact of negative rates remains unclear in terms of what volume of bank reserves might eventually fall into that third tier.

Japanese for “Jawboning”

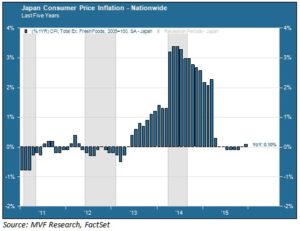

The optics around the rate program may be less about quantifying its impact, and more about sending a signal to markets that Japan’s monetary policymakers are serious about pulling back from the deflation trap which has threatened the economy’s fortunes off and on for the past couple decades. The chart below shows headline Japanese inflation (their headline CPI measure excludes food but includes energy) over the past five years.

Prices in Japan topped out in 2014 shortly after the increase in the consumption tax in April of that year (one of the Abenomics arrows). The government has been forced to push out the expected timing on its 2 percent inflation target time and again. It is likely that Kuroda, by choosing a negative rate decision at this time rather than an expansion of the existing ¥80 trillion per year quantitative easing program, wants to demonstrate that he has more than one policy tool at his disposal. Indeed, the BoJ in its announcement today took pains to not rule out either additional QE or a further rate cut deeper into negative territory if future conditions so warrant.

That Elusive Structural Reform

All the QE and negative interest rates in the world, however, will amount to little more than a tempest in a teapot if Japan is unable to move forward more aggressively with its structural reforms – that elusive third arrow of the Abenomics program. Some efforts have been made – for example, some modest reforms to the country’s excessively coddled agricultural system. Agreeing to participate in the regional Trans-Pacific Partnership with the US and other Asia Pacific economies is also a good step. But Japan continues to suffer from structural problems decades in the making – excessive saving, low household consumption, glacial progress for women in the workplace, and a refusal to countenance sensible immigration reform prominent among them.

Japan needs a “Meiji moment”. In the Meiji era of the nineteenth century the country embarked on a spectacular national program to reinvent itself from a feudal backwater to a leading industrialized nation. It later regrouped from the destruction of the Second World War to produce the miracle economy of the 1950s – 1970s. Today the Nikkei 225 stock index, at around 17,500, remains at a level less than half its peak at the end of 1989. It will take a sustained commitment to deep structural reforms, alongside fiscal and monetary stimulus, to regain that 40,000 all-time high water mark.