Revelers around the world are still shaking out the post-New Year’s Eve cobwebs, but ECB Chairman Mario Draghi rang in the year with words of sober clarity. Deflationary risk in the Eurozone is significantly higher than it was six months ago, Draghi told the German Handelsblatt, and may require “measures at the beginning of 2015” to confront the challenge. Markets are widely interpreting “measures” to mean a full-blown quantitative easing for the Eurozone. The euro continues its downward trend, hovering just above 1.20 to the dollar, in the year’s first day of trading. Yields on key benchmark Eurozone bonds continue their race to the bottom.

Meanwhile, On the Other Side of the Pond…

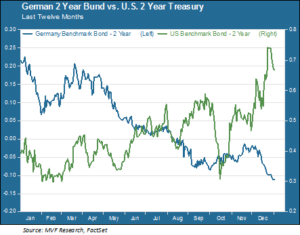

The world seen by Janet Yellen from her office in the Eccles Building, the Fed’s Washington DC headquarters, is starkly different from that described by the ECB’s Draghi. Having wound down QE, the Fed is now faced with the challenge of charting a low-drama course to higher rates. The difference between Draghi’s world and Yellen’s world is clear in the chart below. This shows the direction of the U.S. 2 year Treasury over the past twelve months versus that of the German 2 year Bund:

Short term rates in the U.S. finished 2014 not far from their 52-week high marks, while 2 year Bunds established new 52-week lows. German short term rates have been below zero since August – yes, negative interest rates are an established feature of the new monetary order in Europe. In their parallel worlds Draghi and Yellen each face considerable challenges: the ECB chair must convince markets that policy coordination in the fractious Eurozone is achievable, while Yellen must avoid spooking the markets into the kind of tantrum that her predecessor Ben Bernanke unleashed when he uttered the word “taper” in May of 2013.

What Flavor of QE?

Even if markets expect European QE to be established, the question remains as to what variety is going to be effective. Broadly speaking there are two ways to carry out a quantitative easing policy. The approach undertaken by the ECB to date, through mechanisms like the Long Term Refinancing Operations (LTROs) launched in early 2012, relies on bank intermediation. The idea is that banks are supposed to take cheap money, turn around and lend it out to businesses in need of capital for growth. In practice, though, a greater slice of the LTRO funds remained on the banks’ balance sheets than went into new loan creation. In a low-demand, low-growth environment like the Eurozone there is only so much stimulus that can be applied through bank intermediation.

The other way to accomplish QE is to take a page from the Fed, and inject the stimulus money directly into the economy via open market asset purchases. A comparison of headline numbers between the U.S. and the Eurozone would seem to support this as the preferred approach: on the basis of GDP, employment, retail sales, manufacturing and any number of other figures, the U.S. economy’s trajectory over the past several years has been superior to that of the Old Continent. But such comparisons may also be misleading. There is no clear consensus as to how much of the U.S. recovery may be attributed to QE, the range of views extending from “a fair bit” to “none whatsoever”. QE by itself is unlikely to be a magic bullet: fiscal and other regional and national policies need to also be growth-oriented. That is no easy feat in the 19-member Eurozone.

Faction Before Blood

Perhaps the most difficult roadblock the ECB’s Draghi faces in harmonizing the right flavor of QE with supportive national policies is that of the deep-seated rifts between Europe’s economic policy factions; most notably, the austerity faction led by Germany and other “Northern” nations, and the stimulus faction popular among disgruntled voters in countries where 20%-plus unemployment remains the norm – and that cuts across a wide swath of diverse territories and national identities.

Both the austerity faction and the stimulus faction put forth spirited arguments for their side’s merits versus the other. The austerity argument – that it is folly to deal with a problem of too much debt by creating yet more debt – is logically compelling. But the stimulus camp perhaps holds the trump card: until deflation risk is tamed for once and for all, other approaches will not bring the region back to health before more wrenchingly harsh standard of living declines have played out.

For the U.S., these factional battles are much more than a parlor game to be observed at a distance. Our economy is strong, but not so strong as to be unaffected by the travails of our major trading partners. An aggressive QE approach by the ECB is, we believe, likely to be in our best interests. It may also make it easier for Fed chair Yellen to maneuver her policy ship with the agility necessary to minimize collateral damage in asset markets as rates start to rise. On the policy front, it promises to be a high-stakes 2015.