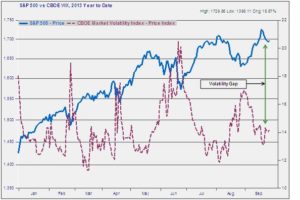

Last week we wrote about “taperphobia” in the wake of the Fed’s decision to back off from plans to start reducing the size of its QE3 monetary stimulus program. After that announcement on September 18, the S&P 500 jumped 1.2%, and then gave back all those gains and more over the course of the next five trading days. Yet the pullback has been relatively gentle as pullbacks go, at least so far. More interesting still is what we call the “volatility gap”. This gap is a measure of the relationship between stock market prices and risk, with the latter being represented by the CBOE VIX index. The larger the gap, the calmer the markets. Here’s how the volatility gap looks as of this writing (afternoon on Thursday 9/26):

The green vertical line indicates that the volatility gap is about as wide as it has been any time this year. Curiously, this comes at a time when a handful of uncertainties loom. In addition to ongoing confusion over the Fed’s non-decision last week, we have the specter of a possible government shutdown come Tuesday next week, and more brinksmanship over the debt ceiling to follow almost immediately thereafter. Is this collective yawn by investors a clever calling of the government’s bluff, or are we in for a nasty October?

Been There, Seen That

There is clearly a rational case to make for calling Washington’s bluff. When the debt ceiling theatrics bubbled up in the summer of 2011, it marked the first time that a normally routine decision involving the legislative and executive branches became an acrimonious political football. For a while it seemed genuinely, stunningly possible that the United States would default on its outstanding obligations. But now these dismal sideshows are a permanent part of the landscape. Sequestrations, fiscal cliffs and budget impasses haunt us at regular intervals. Each time some quick fix is applied so that the worst case scenario does not prevail. Viewed in this context, perhaps the volatility gap is not so curious after all. Investors expect that, regardless of how many Senators posture their way through the midnight hours on an oratory soapbox, and regardless of the slings and arrows of partisan vitriol, life and markets will go along more or less as normal.

Corporate Earnings: Trick or Treat?

If we do manage to jump through the hoops of Washington dysfunction, we still have to contend with the onset of corporate earnings season. Consensus 3Q earnings estimates for the S&P 500 are currently at 3.5%. That’s quite a bit lower than they were at the end of the first quarter. The 3Q consensus as of March 31 was 9.5%, reflecting a gradual souring of analysts’ views of the sales & profits landscape across most industry sectors over the ensuing time. It will be important to see early signs of companies at least able to meet, if not surpass, these lowered expectations.

Follow the Signals

The volatility gap is an important market signal. Continued tameness in this metric would indicate to us that a handful of present trends – including outperformance by cyclical industry sectors over defensives and non-US stocks over US names – may supply a tailwind to take us into year-end. However, as the above chart shows, the volatility gap can also reverse course very quickly. Our outlook remains oriented towards the optimistic. However there are enough potential tricks along the path to keep our attention fully engaged.