When Commodore Matthew Perry sailed into what is now Tokyo Bay in July 1853, the Industrial Revolution had already been galvanizing Western economies for a half century. Japan, by contrast, was an isolated feudal backwater, intentionally cut off from the rest of the world since the beginning of the Tokugawa Shogunate in 1603. Faced with the obvious technical superiority of the West as they stared down the cannon barrels of Perry’s Black Ships, Japan’s leaders realized that nothing short of a far-reaching transformation away from the ossified practices of the ruling samurai class was going to be required. Via the Meiji Restoration that began in 1868, they succeeded. By the end of the nineteenth century, Japan was a modernized industrial power carving out its own empire to compete with those of its Western peers. In 1905 it defeated one of those peers, the czarist empire of Russia, in the Russo-Japanese War and thus firmly established itself as a player in the great-power politics of the age.

The Takaichi Trade

The point of that little history lesson is that one should never count out Japan and its ability to reinvent itself. For the past thirty-odd years it has been easy to dismiss Japan as a once-strong economy whose time has come and gone. The Nikkei 225 stock index failed to regain its 1989 high point until 2024, 35 years later. Demography, deflation and debt summed up an economy listlessly drifting its way into senescence, stubbornly clinging to a shopworn model while the rest of the world raced ahead with successive generations of game-changing technologies.

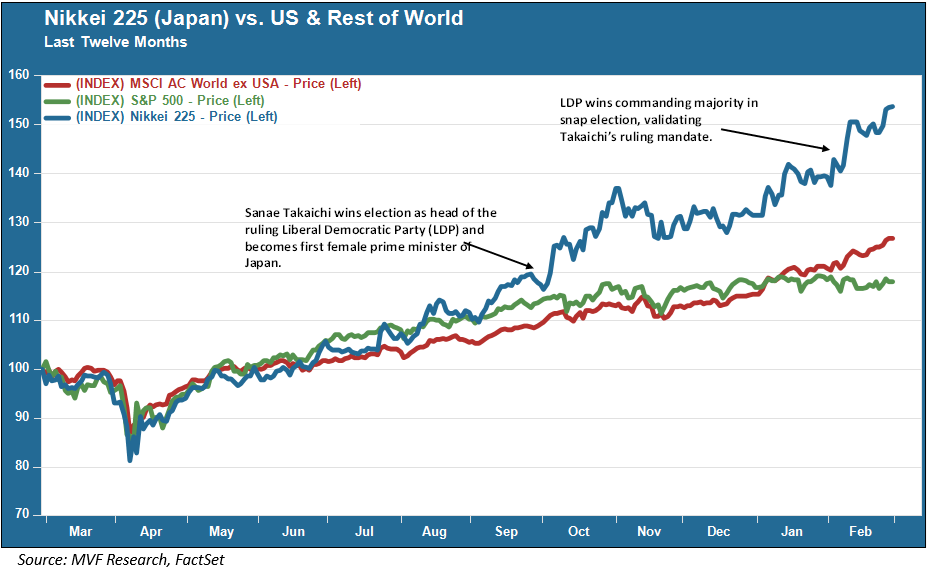

But recently, the country seems to have shaken off the malaise of these so-called lost decades. That long-suffering Nikkei 225 index has gone from also-ran to world-beating over the past twelve months.

A good portion of this outperformance can be attributed to the emergence of a new political star. Sanae Takaichi is a rarity in the world of Japanese politics in two ways: first, she is a woman, the first of her gender to attain the office of prime minister; and, second, that she is wildly popular. Her initial victory last October sent the Nikkei surging, even as the Liberal Democratic Party (LDP) that she heads struggled to piece together a coalition government. It surged again earlier this month when a snap election audaciously called by Takaichi resulted in an LDP victory of historic proportions and a clear green light for the new government to move ahead with its mandate for sweeping economic reform.

The Takaichi Trap

That mandate, though, is not without some potential headwinds. The Takaichi government seeks to implement a major stimulus program to reinvigorate industry, catalyze consumer spending (for example, by eliminating a consumption tax on food products) and establish a stronger geopolitical presence in the region. This last item, which implies a big investment in Japan’s defense industry, has already created some waves after Takaichi made some supportive remarks in favor of Taiwan, remarks that provoked pointed criticism from China. As for the stimulus measures, they are going to have to contend with the Bank of Japan’s attempts to normalize monetary policy and keep a lid on inflation, which has made a somewhat surprising return in the past couple of years. Japanese bond yields have experienced some wobbles of late, as investors try to figure out how the BoJ and the Takaichi government are going to harmonize their respective agendas.

Remembering Shimonoseki

It is, of course, possible that the best laid plans of the Takaichi government will fail in its attempts to re-establish Japan as a highly productive and energetic economy with world-class products and services. But, as we noted above, it is never wise to count the country out. Reaching even farther back into the annals of history, in the late thirteenth century Japan was besieged by the superpower of the day, the Mongol empire of Kublai Khan. After a first encounter in which the Mongols gained some territory but then backed off to regroup, the Japanese built fortified protections strong enough to withstand future assaults. Attack again the Mongol fleet did, but it failed to penetrate the fortifications, and while the fleet was stranded in the straits of Shimonoseki trying to advance, it was destroyed by a great typhoon – the “divine wind” the Japanese translation of which is “kamikaze.” The Mongols never attacked again.

Japan is a highly conservative society with a pronounced resistance to change. But when it puts its mind to it, the country has shown in the past that it is capable of remarkable change in a very short period of time. As nations around the world grope for position in the changing global order, it may be time to give Japan another, closer look.