It’s April Fool’s Day, but nothing in the way of impish pranks came from the Bureau of Labor Statistics this morning. The BLS served up another predictable, steady helping of employment data, headlined by monthly payrolls growth of 215,000, slightly ahead of expectations, and a slight uptick in the unemployment rate to five percent. That small rise in unemployment itself was nothing to bemoan, as it resulted from gains in the size of the labor force (more people looking for work with not all of them finding jobs right away). Wages grew at a decent 2.3 percent annual clip. The labor force participation rate is still low by historical comparison, but is up a bit from its 2015 lows.

Different Trends for Different Times

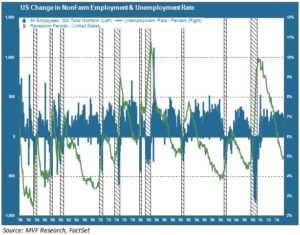

In fact, most key employment indicators are modest by comparison to previous recovery periods. That is concerning to some, especially given that it follows the deepest losses in the labor market since the Second World War. The chart below shows the monthly change in nonfarm payrolls, and the corresponding unemployment rate, going back to 1950. The gray columns indicate recession periods.

It is true that the pace of job creation in the current recovery period falls short of what the long recovery periods of the 1980s and 1990s produced. The growth period from December 1982 to July 1990 saw average monthly payroll gains of 228,000 and an average unemployment rate of 6.8 percent. The corresponding figures for the go-go years of the 1990s (April 1991 to March 2001) were 201,000 monthly jobs and a 5.5 percent average unemployment rate. Since the most recent recession officially ended in July 2009, 157,000 payroll gains and a 7.6 percent unemployment rate are the corresponding monthly averages.

But when we take into account other contextual considerations, the second decade of the 21st century doesn’t look all that bad. Consider that during the great growth run of the 1960s, a time when average annual GDP growth ran to 4.9 percent (March 1961 to December 1969), average payroll gains ran to 167,000 with an unemployment rate of 4.7 percent. GDP growth during the most recent recovery, by comparison, has averaged just 1.8 percent. It’s a different time, with a more mature economy unlikely to return to the kind of growth we experienced in the 1950s and 60s. This is not to downplay the very real problems we have in the economy today, about which we have made extensive comment in recent articles. But the continuingly predictable employment picture indicates a firm underpinning to this recovery, and a correspondingly low likelihood of an imminent recession. And one final note on this historical comparison: the span of time from the last negative payroll number (September 2010) to the present is the longest postwar streak of positive monthly gains.

Next Up: Wages and Prices

This month’s BLS report also contained some good news on wages, which increased by seven cents to an average hourly rate of $25.43. That represents a 2.3 percent annual increase, meaning that inflation-adjusted purchasing power grew for the average worker over the past year. We are starting to see signs of a general recovery in prices, with core inflation and personal consumption expenditure among the recent data points indicating a drift back towards the Fed’s target expectations. Fed Chair Janet Yellen herself sees no urgency in the latest numbers, as clearly conveyed in her dovish post-FOMC comments and again in a speech in New York earlier this week. Markets also remain unconvinced that the pace of inflation is picking up all that much. That could change, though, if the headline macro numbers continue to beat consensus estimates.

Kinder, Gentler Spring?

Jobs Fridays like today’s are unlikely to move markets much; as we write this, the S&P 500 is more or less flat for the day as it heads to the end of what has been a fairly lethargic week. With the Q1 earnings season getting underway next week, more attention is likely to be focused on how companies are guiding their sales and earnings estimates, and whether recent softness in the dollar is starting to influence mindsets in the boardroom and on the trading floor. Valuations may continue to provide resistance on the upside. What Jobs Fridays like today may do, however, is to suggest that we may still have some way to go before the next recession bear casts its shadow. That in turn may help cushion any further pullbacks emerging out of the myriad global risks that remain at play.