To Our Clients:

We have heard from a number of you over the past several weeks with questions about what is happening in the markets – whether there is potentially cause for concern given some recent developments, and what else may be having an impact on your portfolio between now and the end of the year. In this letter we will share with you some observations that are contributing to our market view and decision framework.

Act I: The Year to Date

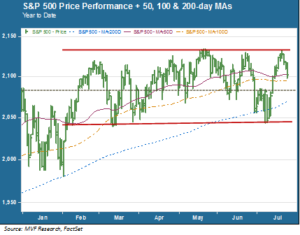

For an opening act, let us shine a bright light on what has been a rather unusual several months. In late April, benchmark German interest rates experienced a sudden and unexpected surge of more than 700%. June and the advent of summer brought with it a default by Greece on a loan payment to the IMF, raising the probability of a Greek exit from the Eurozone with unknown consequences. Finally, China’s high-flying domestic stock market got a little too close to the sun and collapsed, giving up more than 40% over the latter half of June before stabilizing as a result of massive government intervention.Yet for all that action, the one remarkable characteristic of US equities during this time has been a distinct lack of conviction. Consider the chart below, which shows the performance of the S&P 500 stock index in the year to date.

The S&P ended 2014 around a price level of 2080 (indicated by the dark gray dotted horizontal line). Following a very volatile January and then a strong breakout rally in February, the benchmark index has mostly traded in a range in more or less equal distances above and below the year-to-date break-even level. For the last five months, nothing has been able to catalyze a sustained upside or downside directional movement. What is causing this stubborn lack of conviction?

We believe the upside resistance tracks back to a main theme raised in our Annual Outlook back in January: namely, that after a three year run in which stock price gains far outpaced growth in corporate earnings, those earnings were likely to act as a limit on price growth. The May 21 high water mark for the S&P 500 this year represents about a 4.3% total year to date return, which is not too far away from consensus projections for fiscal year 2015 earnings per share growth for the companies which make up the index. The upside directional headwinds, then, may be mostly about earnings.

On the downside we see a similar phenomenon: there has not been a single pullback this year of a peak-to-trough magnitude of 5% or more, and for the most part the reversals have found support at key technical indicators like the 100 and 200 day moving averages. Now, part of the downside resilience is arguably event-driven – neither China’s stock collapse nor the Greek debt crisis resulted in a worst-case outcome. More broadly, though, we do not see a compelling bear case for US equities. The low likelihood of a near-term recession, along with a sense that the key prevailing risk threats are outside the US, help make the case for downside support.

Act II: The Year Ahead

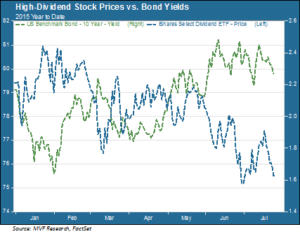

Keeping to the theme of events impacting market performance, perhaps the most significant development that has yet to play out in the second half of the year is the Fed’s decision on interest rates. This event is of particular interest to diversified portfolios with significant yield exposures – for example to high dividend stocks, convertible bonds and REITs. Generally speaking, exposure to these asset classes makes sense in a world of near-zero interest rates. They have been, and continue to remain, an important part of our asset allocation strategy. Recently, though, there has been a very close inverse correlation between short-term movements in interest rates and the price performance of enhanced-yield assets. The chart below provides one such illustration, showing the year-to-date performance of high dividend stocks compared to the yield on the 10-year Treasury note.

We believe the Fed is likely to make its initial move on interest rates sometime between September and December, with the timing depending mainly on the growth, inflation and employment data points that come in between now and then. So, it would be reasonable to ask what we are planning to with our enhanced-yield exposures in a rising rate environment.

To answer the question we need to consider the larger picture. Short-term traders are focused entirely on the first rate hike – as illustrated by the above chart – but that is not the right focus for the long term portfolios under our management. What kind of economic environment do we expect to prevail over the intermediate term – in the next two to three years? The base case scenario driving our investment decisions is an environment of low growth in the US and other developed markets, and a continuation of below-trend growth in emerging markets. This scenario envisions a very gradual pace of interest rate increases, with the Fed ever ready to suspend a rate increase program if low positive growth turns flat or negative. We believe that enhanced-yield assets will continue to play an important role in this environment, as yields on high dividend stocks, REITs, Master Limited Partnerships and other similar assets are likely in these circumstances to remain attractive relative to high quality fixed income issues. We also believe that the underperformance of enhanced-yield assets in 2015 is partially a case of “sell the rumor, buy the news”. Once the first rate hike takes place and the world does not come to an end as a result, we expect phenomena like the “dividend-rate trade” to subside.

There are of course many other variables at play that we continue to monitor closely. We will continue to share our thoughts with you as and when our views adapt to evolving market realities.