The US stock market has been in one of those glass-half-empty moods for some weeks now, down nearly seven percent from the year-to-date high reached on July 31. There are several objects in the grab bag of negative news offered by the financial press to explain Mr. Market’s current malaise, one of them being the seemingly inevitable government shutdown about to happen. Given that the shutdown technically goes into effect on Sunday night (unless Congress has a magic trick to reveal that nobody has seen yet), this would seem to be a good time to take a closer look at the past history of shutdowns and the market.

Less Often Than You Think

This being the Washington, DC metro area, shutdowns are a pretty big deal (and an unpleasant one) for many of our fellow citizens who call the DMV home. In the course of casual conversations we often hear something to the effect of “yeah, these things happen all the time.” Do they, though? Well, the federal government has technically shut down 14 times since the beginning of the Reagan Administration. The vast majority of these shutdowns, though, lasted between just one and three days. There was a one-day shutdown in 1982 that happened for the sole reason that the leading figures in both the Republican and Democratic Parties had social functions that day that prevented them from the work needed to keep the government open (there is a memorable photograph of President Reagan being serenaded by Tammy Wynette during a barbecue on the South Lawn on the evening the shutdown was going into effect).

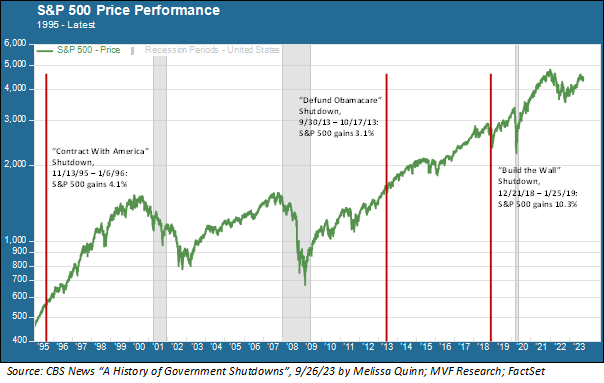

On only three occasions did the shutdown persist for more than three days. On none of these three occasions did the shutdown have any apparent effect on the stock market. Here’s a chart with the data.

Performance and Capitulation

The three shutdowns that persisted for more than a week were, for the most part, unwinnable ideological battles waged more for theatrical posturing than any real hope of achieving something. In November 1995 the Republican Congress under Speaker Newt Gingrich, flush with success after their sweeping victories in the 1994 midterms, pushed for the inclusion of their so-called Contract With America into budget discussions. These included repeal of the Clinton Administration’s 1993 tax increases and a balanced budget amendment. The parties briefly agreed after five days to fund the government while negotiations continued, but this agreement fell apart in December and the shutdown persisted for another 21 days. Public opinion swung against the Republican-led Congress, which finally backed down and ended the standoff. Meanwhile the stock market yawned, paid more attention to other things going on at the time and ended up 4.1 percent higher at the end of the standoff.

The 1995 template pretty much played out in similar fashion during the other two multi-week standoffs. In 2013 the Republican Congress pushed to dismantle key provisions of the Affordable Care Act, one of the signature policy accomplishments of the Obama Administration. Once again the drama was Kabuki-like in its flashiness without much substance. The standoff lasted for 16 days until Speaker John Boehner’s patience with his own team ran out and a spending bill was passed with no impact on Obamacare. Once again the stock market basically ignored the drama and continued what was already a very up year, gaining 3.1 percent during the shutdown for reasons utterly unrelated to it.

The longest shutdown to date happened at the end of 2018, the dispute this time centering on the Trump administration’s objections to a Senate appropriations bill that did not include $5.7 billion in funding for the border wall that was one of the administration’s constant talking points. Lots of political jiu-jitsu from all sides kept the shutdown dragging on until the administration agreed to a stopgap bill on January 25 that reopened the government. This time, the S&P 500’s gain of 10.3 percent really had nothing whatsoever to do with Congress or the White House, and everything to do with the Fed. The central bank had pivoted on its monetary tightening program, pausing rate hikes in December amid a near-bear market in stocks. The S&P 500 bottomed out just two days after the government shutdown began and soared through January as investors cheered the Fed’s pivot.

What About This Time?

So that’s the history. What about this time? Are there reasons to believe that this shutdown (assuming it happens) is going to be of a magnitude or more different from the previous occasions? Well, the Kabuki element is certainly there. Once again, it seems like ideologically-tinged performative politics is driving the bus. The public, we believe, has a certain reserve of resigned tolerance for these theatrics, but at some point not very long from now, the tolerance will wear off. At least for now, our take on things is that the shutdown will resolve itself through whatever arcane mechanics the key players come up with this time, allowing everyone to save a little face and sate their voting base back home with clickable outtakes. We will of course be monitoring events as they transpire. And we are dismayed that once again the dysfunctions of our political leaders are on public display for the world to see – but such are the times in which we live. Here’s hoping that public pressure will kick in and bring the antics to an end sooner rather than later.