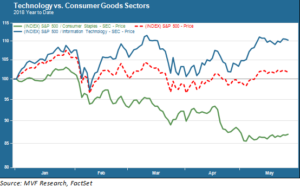

It’s a very good thing for US large cap equity investors that consumer staples companies make up only 7.4 percent of the S&P 500’s total market cap, while the tech sector accounts for 25.4% of the index. The chart below shows why.

Tech stocks have outperformed the market for most of the year to date, while consumer staples have experienced a miserable couple of quarters. Here’s where those market cap discrepancies really matter: the fact that tech stocks make up a quarter of the total index means that their performance “counts” for more (we explained this in one of our commentaries a couple months ago). So, even though the magnitude of underperformance for consumer staples is greater than that of tech’s outperformance, the heavyweight sector pulls up the broad market (the dotted red line represents the total S&P 500) and, for the moment anyway, keeps it in positive territory.

Weak Defense

So what’s going on with consumer staples? By one yardstick – market volatility – the sector might have been expected to outperform over the past couple months. Consumer staples has long been regarded as a defensive sector, i.e. one which tends to do better when investors get jittery. The logic is easy to follow. A volatile market signals uncertainty about the economy, which in turn leads to households tightening their budgets. So things like expensive vacations and designer labels (which would show up in the consumer discretionary sector) get the axe, but folks still have to buy toothpaste and breakfast cereal (which are manufactured, distributed and retailed by consumer staples companies like General Mills, Sysco and Costco).

But two technical corrections of more than 10 percent didn’t send investors flocking into defensive stocks. Other traditional defensives, such as utilities, also fared relatively poorly during this period. There is one driving variable common to a variety of traditional defensives, which is rising interest rates. But there are a couple others that are particularly relevant to the woes in consumer staples.

Hard Times for Dividend Aristocrats

The connection between interest rates and defensive stocks is fairly straightforward. These stocks tend to have higher dividend payouts than more growth-oriented shares. For example, the average dividend yield in the consumer staples sector is around 3.1 percent, compared to an average yield of 1.8 percent for the S&P 500 as a whole. The relative attraction of dividends diminishes when income yields on high quality fixed income securities (like Treasury bonds) increase. This relationship is then exaggerated to an even greater extent by the abundance of algorithmic trading strategies that mindlessly key off small changes in rates, sending cascades of buy and sell orders beyond what many would see as the actual fundamental value shift.

The Worst of Times

Two other variables with a particularly pernicious effect on consumer goods companies are inflation and changing demand patterns. These variables are closely related. While inflation is still relatively low by historical standards, it has ticked up in recent months. Cost inflation – basically, higher input costs for the raw materials and the labor that go into the manufacture of consumer goods – puts downward pressure on profit margins. If companies can pass those cost increases on down the value chain – i.e. from manufacturer to distributor to retailer to end consumer – then they can contain the effect of cost inflation. But that means, ultimately, having consumers willing to pay up for the staple items they buy from week to week. And this is where that second variable – demand patterns – comes into play.

Simply put, consumers have become pickier about what they buy and how they buy, and they have a far greater spectrum of choices from which to curate their own particular needs and preferences. Time was, the weekly shopping cart was pretty predictable in terms of the packaged goods with which Mom and Dad filled it up, and also where the shelves containing those goods were located. Established brands carried a premium that was a predictable source of value for the likes of Procter & Gamble, Coca-Cola or Kraft Foods. That brand premium value hasn’t disappeared – but it has become diluted through an often bewildering assortment of products, categories and messaging. The emotional tie between a consumer and a favorite brand dissipates when the products and the messaging are constantly changing, popping into and out of existence like quantum matter.

That dynamic makes it much harder, in turn, for companies to convince their customers to accept the passing on of cost inflation. The logical outcome is lower margins, which have been the wet blanket souring quarterly earnings calls this year. Unfortunately for the companies in this sector, these are not problems that are likely to disappear with the next turn in the business cycle. Even the elite leaders, such as P&G and Unilever, have daunting challenges ahead as they try to leverage their storied pasts into the unforgiving environment of today.