The Agony and the Ecstasy, one could say. Irving Stone’s famous 1961 novel may have been about the life of Michelangelo and his tortuous experiences while painting the Sistine Chapel, but the phrase easily lends itself to this week’s journey from darkness to light in the US stock market. As we wait for trading to get underway on this Friday morning, all appears well once again, thanks largely to the doings of one company and its continued ability to outdo the ever-higher expectations set by the market.

Hedgies Caught Out

Nvidia, the company that appears to have a dominant position in the market for the semiconductor chips that power all things AI, reported its fourth-quarter earnings after the market close on Wednesday. Heading into that report the market had been in something of a funk. Expectations for Nvidia were sky-high; after all, the company’s stock had risen by more than 200 percent in the past twelve months, and its quarterly sales and earnings numbers within that time had blown the doors off analyst estimates. The AI mania of which Nvidia was arguably the central asset of focus had carried the rest of the market with it, led by seven companies that came to be known as the Magnificent Seven.

Surely it was time for a recalibration, thought the collective wisdom. Nvidia’s stock traded down around nine percent in the three days before its Wednesday aftermarket report. Hedge funds, those incandescently brilliant operators who charge two percent plus a cut of profits for the privilege of riding along in the wake of their shining genius, were collective sellers of Magnificent Seven stocks for five of the six trading days through Wednesday’s close. Meanwhile, the release of minutes from the last FOMC meeting last month appeared to reaffirm the central bank’s intention to sit pat for the time being and not cut rates, lending another minor key note to the already dour tone of the market.

Seemingly Bottomless Demand

Then the numbers came out, and boy did that sentiment do a U-turn. There seems to be almost no end to the demand for what Nvidia sells, which is a graphic processing unit (GPU) platform providing the capability to employ generative artificial intelligence at scale. Data centers, who represent Nvidia’s largest customer base in this segment, bought more than $18 billion worth of these products in the fourth quarter, topping off a year in which sales for this segment grew more than 400 percent. Profit margins were also higher, and forward guidance (one of the biggest concerns among analysts heading into the earnings report) also beat expectations.

The ensuing market rally on Wednesday didn’t just limit itself to US tech stocks, though most of those did fine, especially any that can make a plausible claim to having a good AI story to tell. On Thursday the Japanese Nikkei 225 stock index surged past 39,000 to close at its highest level ever – fully 34 years after its previous record close! The bullish sentiment in the Japanese market, which includes a handful of world-class semiconductor names, traced directly back to that Nvidia earnings report. Softbank, a Japanese firm with a venture capital arm that has had more than its share of troubles in recent years, was a particular beneficiary of the latest iteration of “AI saves the day.”

All was well that ended well, except for all those smart-money funds that sold out of Nvidia and the other AI leaders before Wednesday evening.

Seven, Six, Five or Four?

On its earnings call Nvidia described the current market for GenAI as being at a “tipping point” – a phrase normally interpreted as a moment when a trend moves from linear to geometric expansion. That may or may not be the case, but for the moment, anyway, there does not appear to be any indication that demand for the infrastructure needed to run AI applications at scale is going to diminish.

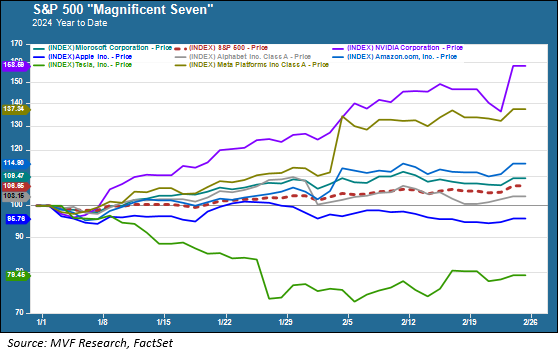

That being said, it is probably time to revisit that “Magnificent Seven” moniker. The group of companies that drove the market in 2023 has diverged somewhat in 2024, for a variety of reasons. At the moment, only four of the companies are actually ahead of the S&P 500 for the year to date.

Tesla, in particular, has been having a bad time of things, as whatever story it can tell about AI in its value proposition has been overshadowed by the specter of competition from electric vehicle manufacturing in China. Apple has struggled somewhat as well, also in part due to competition eating into its sales in China, one of its most important markets. In fact, only Nvidia and Meta (Facebook), which also had a blockbuster earnings report a few weeks back, are notable outperformers.

In our annual outlook last month we noted that 2024 may be the year when the general halo around AI breaks down into a more sober scrutiny of which companies actually are profiting from it and which ones don’t really have a compelling core use case. That may be starting to happen. For the moment, though, it seems the market will continue to swim along with the established market leaders – as long as they can continue to pull those sales and earnings rabbits out of the hat.