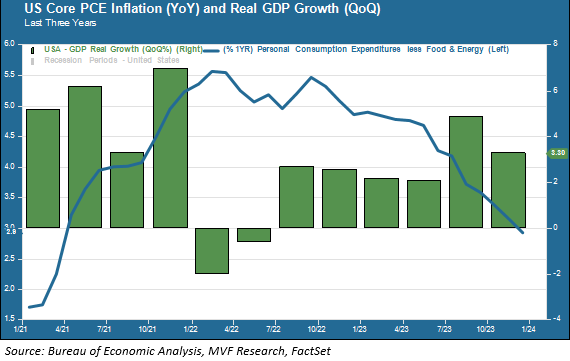

This week brought with it a couple more pieces of data to suggest that the positive trend the US economy enjoyed throughout 2023 is far from over. The good news this week: Gross Domestic Product (GDP) grew at a real quarterly rate (annualized) of 3.3 percent for the fourth quarter, which translates to a 3.1 percent annual rate for the full year of 2023. That is a much stronger growth rate than economists had expected, and notches yet another win for the US as the world’s best-performing advanced economy.

Today we got the second installment of Goldilocks data (not too hot, not too cold) with the Personal Consumption Expenditure price index. The PCE (excluding food and energy categories) is the inflation metric the Fed pas closest attention to in its monetary policy deliberations. For December, the month-on-month PCE growth was just 0.17 percent, which translates to a year-on-year growth rate of 2.9 percent. That is the lowest level since March 2021, and also breaks the psychological 3.0 percent level.

Consumers Still Having Fun (And Not Paying As Much)

The better-than-expected GDP growth was driven once again by strong consumer spending, with the holiday shopping season also exceeding expectations. Some of the best-performing categories, interestingly, were discretionary areas like restaurants and recreational vehicles. Apart from consumer spending, nonresidential fixed investment and exports were also net positives in the GDP equation.

The decline in inflation, as measured by the PCE, is only partly due to the extended period of monetary tightening by the Fed. Indeed, the pace of consumer spending over the past twelve months by itself would seem to suggest a sticky path for inflation coming down. But remember that one of the key driving factors in inflation when it started to rise in 2021 was not from the demand side but rather from the busted-up supply chains that were still trying to work themselves out of the pandemic. The inflation formula was simple: more money (pent-up demand from the lockdown period plus government stimulus money) chasing fewer goods squeezing through those supply chain bottlenecks. Those problems have more or less righted themselves, so now we have an adequate supply of goods and services to meet the still-brisk demand. The result is inflation inching ever-closer to the Fed’s two percent target.

People Starting to Notice

It seems that the persistence of good economic news may finally be enough to sink into the dour consciousness of the fine American citizenry. In our annual investment outlook, which our clients will be receiving shortly, we talked at some length about the “vibes” economy in which a majority of people expressed anywhere from a moderate to high level of dissatisfaction with the economy, to the point where a not insubstantial plurality insisted (incorrectly) that we are actually in a recession. In our annual report we pointed to one statistic, a consumer sentiment report published by the University of Michigan, that showed consumers being just about as down on the economy in recent months as they were during the recession of 2008 (a much, much worse economic period than today).

Well, lo and behold – the January number for the Michigan sentiment index just came out, and it showed a 13 percent increase from the December figure. That uptick tracks with a Pew Research poll that also came out this week, showing about a nine percent increase in the number of respondents categorizing the economy as “excellent” or “good.” Now, to be fair, that cohort still represented only 28 percent of those polled, so there are still plenty of doubters out there. Perhaps another month or two of Goldilocks-type data will bring them on board. We shall see.