Longtime readers of our research and commentary know that we spend quite a bit of time dwelling on the economic metric of productivity. Our reason for that is straightforward: in the long run, productivity is the only way for an economy to grow in a way that improves living standards. Curiously, the quarterly report on productivity issued by the Bureau of Labor Statistics generally fails to grab the kind of headlines the financial media readily accord to unemployment, inflation or GDP growth. So there is an excellent chance that today’s release showing a drop of 0.1 percent in productivity growth for Q4 2017 (and a downward revision for the Q3 number) didn’t show up in your daily news digest. And while one quarter’s worth of data does not a trend make, the anemic Q4 reading fits in with a larger question that bedevils economists; namely, whether all the innovation bubbling around in the world’s high tech labs will ever percolate up to deliver a new wave of faster growth.

Diminishing Returns or Calm Before the Wave?

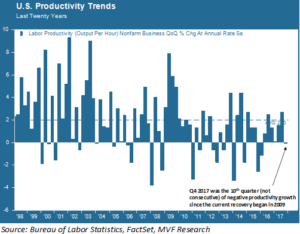

The chart below shows the growth rate of US productivity over the past twenty years. A burst of relatively high productivity in the late 1990s and early 2000s faded into mediocrity as the decade wore on. After the distortions (trough and recovery) of the 2007-09 recession, the subsequent pattern has for the most part even failed to live up to that mid-2000s mediocrity.

There are two main schools of thought out there about why productivity growth has been so lackluster for the past 15 years. The first we could call the “secular stagnation” view, which is the idea that we have settled into a permanently lower rate of growth than that of the heyday of 25 years or so following the Second World War. The second school of thought is the “catch-up” argument, which says that scientific innovations need time before their charms fully work their way into the real economy. Readers of our annual market outlooks may recall that we closely examined the secular stagnation argument back in early 2016, while the catch-up philosophy occupies several pages of the 2018 outlook we published last week.

The most persuasive evidence made by the catch-up crowd is that both previous productivity waves – that of the late ‘90s – early 00s shown in the above chart and the longer “scale wave” that ran from the late 1940s to the late 1960s – happened years after the invention of the scientific innovations that powered them. Most economists ascribe a significant impact to the products of the Information Age – hardware, software and network communications – in explaining the late 1990s wave. But those products started to show up in business offices back in the early 1980s – it took time for them to make an actual impact. According to this logic, it should not be surprising that the potentially momentous implications of artificial intelligence, deep machine learning, quantum computing and the like have yet to show that they make a real difference when it comes to economic growth.

Productivity and Inflation

The economic implications of productivity tend to be longer term rather than immediate – that is probably why they don’t merit much coverage on the evening news when the BLS numbers come out. After all, the economy is not going to stop growing tomorrow; nor will millions of jobs disappear in one day if another productivity wave comes along with the potential to make all sorts of service sector jobs redundant (a point we make in our 2018 outlook if you’re interested). The lack of immediacy can make productivity debates seem more like armchair theory than like practical analysis.

But productivity (or its lack) does have a lot to do with a headline number very much in the front and center of the daily discourse: inflation. What the BLS is reporting in the chart above is labor productivity: in other words, the relationship between how much stuff the economy produces and how much it costs to pay for the labor that produces that stuff. If compensation (wages and salaries) goes up, while economic output goes up by a smaller amount, then effectively you have more money chasing fewer goods and services – which is also the textbook definition of inflation.

In fact, the BLS notes in its Q4 productivity release that higher compensation was indeed the driving factor behind this quarter’s lower productivity number. Bear in mind that unemployment is currently hovering around the 4 percent level (this is being written before the latest jobs report due out Friday morning), and anecdotal evidence of upward wage pressures is building. An upward trend in unit labor costs (the ratio between compensation and productivity) has the potential to catalyze inflationary pressures.

Keep all this in mind as we watch the 10-year Treasury inch ever closer towards 3 percent. As we noted in our annual outlook, it makes sense to watch the bond market to understand where stocks might be going. And anything related to inflation bears close monitoring to understand what might be happening in the bond market.