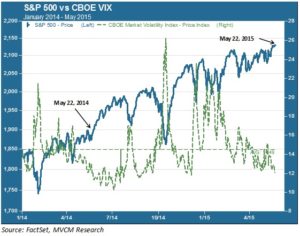

History doesn’t repeat itself, but sometimes the rhyming is uncanny. As the first half of 2015 heads into its final month, perhaps its most distinguishing feature is the resemblance to 2014 through the same third week of May. An early stock market pullback with volatility spikes, a sharp recovery in February, some lousy macroeconomic data points, and then a meandering S&P 500 within a fairly tight band of support and resistance levels are characteristic of both this year and last. And in both instances we see a nascent pattern of upside breakout and falling volatility in that third week of May, illustrated in the chart below.

In 2014 that late-May uptick morphed into a summer of tranquility. The VIX plummeted to near-record lows while stocks glided gently upwards through June and July. Can we expect a similarly idyllic drift down the river as this summer gets underway, or do more Andean volatility peaks lurk around the next bend?

Waiting for GDP…

A robust 2Q GDP report would really ice the cake for the 2014/15 comparison. Last year’s 2Q showing of 4.6% real GDP growth put to rest the fear that the 1Q contraction had to do with anything more than the unusually cold winter across most of the country. We won’t know this year’s 2Q figures until late June, but anything over 4% would be well ahead of the current consensus. For example the Atlanta Fed, which correctly predicted the below-consensus 1Q outcome, expects 2Q GDP to come in at a paltry 0.9%. Following a string of unimpressive retail sales numbers and recent reversals in the consumer confidence index, the 2Q GDP number takes on particular significance this year. The prevailing meta narrative for the past couple years has had the US leading a global recovery which, if modest by past norms, is at least positive enough for reasonable job creation and wage growth. Yet Europe and Japan – perennial laggards both – grew more in the first quarter than did the US. Continuing sub-2% growth could prompt investors to revisit the assumptions underlying their asset pricing models.

…and the Fed

The FOMC’s next conclave is June 16-17, a week before the 2Q GDP numbers come out. The timing makes it very unlikely that we will have any definitive guidance on rates when Chairwoman Yellen faces the cameras on the afternoon of the 17th. Today’s April Consumer Price Index release was mildly bullish, with core CPI (ex food and energy) trending up to 1.8% year-on-year, but still below the 2% target. The final headline number the FOMC members will have to take into their June meeting will be May jobs, due out a couple weeks from today. Unless payroll gains come in over 300,000 or below 100,000 (either of which, of course, is possible) it is hard to see what could move the needle enough to induce the Fed to either give a date or take a 2015 hike off the table.

No News is Good News?

The lack of conclusive evidence either for the economic growth narrative or the Fed’s timing may, in the absence of any other X-factor surprises, work to the market’s advantage in a version of “ignorance is bliss”. Indeed the current sentiment appears blissfully placid. The surprising recent spike in European bond yields has done little to shake this complacency, with shares trading up and the VIX staying mostly below its 1.5 year average. The recently concluded earnings season had little impact on share prices one way or the other, despite dire predictions going into the season. And geopolitical news continues to be the yawn-inducing nonevent that appears to have become the norm. While a seismic pullback is never out of the question, we see little to indicate that one is right around the corner. “Sell in May” would have been poor advice in 2014, and we are not inclined to do so in 2015.