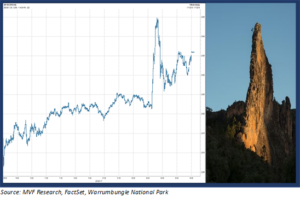

What do global capital markets and the Warrumbungle National Park in New South Wales, Australia have in common? Topology, for one. In the chart below we have juxtaposed an image of one of the best-known features of Warrumbungle, known affectionately as the Breadknife, with yesterday’s price trend graph for the S&P 500. The similarity, we think you will appreciate, is remarkable.

The Topology of the Twitterverse

What exactly was it, shortly after 2:30 pm on Thursday, that sent the broad-based US stock index into its best imitation of an eastern Australian rock formation? Something on Twitter, of course, because that is where most news headlines land a few microseconds before they make it into the pixelated pages of mainstream news outlets. The little item in question was a report from Steve Mnuchin’s Treasury Department suggesting that sanctions on China should be lifted in order to encourage a settling of the trade dispute between the US and China. The chronology goes thus: a snippet of the Treasury report made its way onto Twitter, where it was gobbled up by a vast gaggle of tradebots that feed solely off the effluvia and attendant waste products of social media. Stock prices jumped by some three quarters of a percent from where they had hitherto been ambling along.

Almost immediately afterwards came a countervailing comment from Robert Lighthizer, the US Trade Representative, throwing cold water on the idea that sanctions should be lifted. The White House, for what it’s worth, chimed in to quash the idea that lifting sanctions was a possibility in the immediate future (it’s worth noting that the only other meaningful piece of trade-related news earlier in the day was a report that the US, in trying to pressure the EU to buy more agricultural products to offset declining exports to China, was thinking of slapping some new tariffs on automobile imports). The Breadknife crested and shaped the contours of its downward slope back close to where it had begun. Trading ended on a reasonably optimistic note because, apparently, the winning theme was “if someone’s even talking about sanctions at all it must mean the atmospherics are a bit better than they were.” Or something to that effect. Win!

Life In Volatile Times

To be clear: there was technically no news – nothing of any substantial meaning – that transpired between 2:30 pm and the banging of the antique gavel on the floor of the New York Stock Exchange at 4 pm with whatever invitees of the day slow-clapping the close of another trading session. Nothing to merit that Breadknife of 75 basis points up and down. So it goes in a jittery market where rumors, counter-rumors and the sudden catalyzing of vague sentiments one way or the other drive share volumes on any given day. For most of the year thus far (all two weeks and change of it) the prevailing sentiment has been mostly of the glass half full variety. Last month was quite the opposite, where every little X-factor that bubbled to the surface on any given day was a raven foretelling the imminent arrival of the Four Horsemen of the Apocalypse. Expect more of these back-and-forth reels as the year goes on.

Early next week we will be releasing our 2019 Annual Outlook, the main theme of which is that the principal characteristic of risk assets this year is likely to be volatility. Volatility goes up and volatility goes down – just like the Breadknife in Warrumbungle National Park. When markets gyrate excessively in response to the continuous stream of drivel that courses through the Twitterverse, what matters most is staying disciplined and focused on the things that do matter.