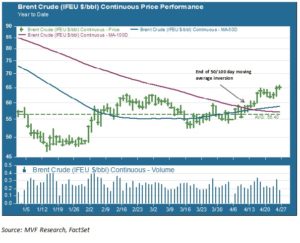

It’s been a good couple weeks to be on the long side of a crude oil futures contract. Animal spirits were in full force Thursday as hedge funds and others poured into the market, driving Brent crude futures to their highest level for the year to date. As the chart below shows, this is the second upside breakout of significance this year, pushing the 50-day moving average back above the 100-day average for the first time since they inverted last August. That may be good for some near term technical momentum. But does this rally have the fundamental legs to keep pushing up, or are we headed for another push me-pull you reversal similar to what happened in March?

The Rig is Up

Some prominent industry voices are confident that the sub-$50 oil of January is firmly and finally in the rear-view mirror. At the FT Commodities Global Summit in Switzerland this week former BP chief Tony Hayward opined that prices could reach $80 in the not-to-distant future. That would leave more than 20% of additional upside achievable from today’s levels, and that appears to be what the hedge funds are betting on. The argument for this view is a near-term combination of slightly improved demand and declining production, in particular from the shale drillers. For example, the active rig count in the US this month is about half what it was late last year. The Energy Department expects a decline in US crude production later this year from the current level of 9.4 million barrels/day. This is essentially the card Saudi Arabia played at the November OPEC meeting last year – price the more expensive producers out of the market and grab share.

Storage Wars

The bullish case is by no means universal, however. Exhibit A in the doubters’ case is US inventory levels, which are higher than they have been at any time in the last 80 years. It is also not entirely clear how much demand is perking up, despite some recent upward revisions in demand forecasts. Growth is slowing in China and remains subdued in Europe. At a more structural level, though, measures like rig count do not tell a complete story about the production landscape in the US. The technology for unconventional drilling is evolving rapidly. As it evolves, the cost threshold for profitable production comes down. And the life cycle of shale extraction is typically shorter than it is for conventional wells – about 60-70% depletion in the first year. That arguably gives producers the ability to turn production off and on more quickly in response to changing price and demand trends. Indeed, a recent New York Times article makes a decent case for the US replacing OPEC as the world’s swing producer.

Swinging Seventies?

So what do all these crosswinds mean for prices? Perhaps the most appealing scenario is a reduction of volatility as crude benchmarks settle into a range-bound pattern, with a floor supported by tempered rates of production and upside capped by inventories and improving cost economics for US producers. We do not necessarily disagree with Mr. Hayward’s assessment of $80 oil as reachable, but we think it plausible that this could be the upper boundary of a $70-80 range for the near to intermediate term. Of course there are plenty of other variables at play. Iranian capacity could be a factor depending how the recent framework agreement plays out. The impact of the situation in Yemen is currently being felt. There are valid upside and downside scenarios for global demand. Net-net, though, we can see a reasonable path to the seventies.