A quick glance at recent headlines in the world’s second largest economy doesn’t reveal much in the way of good cheer. There is the recent collapse of Shanxi Platinum Assemblage Investment, one of the so-called “shadow banks” that figure prominently in real estate and other speculative ventures. Many China watchers have concerns about price weakness in the property sector (which in turn could be a catalyst for more shadow bank failures). Headline growth has been running below trend. And a soaring dollar makes commodities like copper and aluminum more expensive for the world’s leading consumer of industrial raw materials.

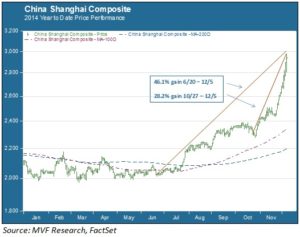

But the negative vibes are certainly nowhere to be seen in China’s equity markets. The Shanghai Composite Index, shown in the chart below, has been on a tear, rising nearly 30% since the end of October. That’s right: 30% in a bit over one month. Since the middle of the summer the index has soared 46%.

A Retail Affair

What’s driving these manic animal spirits, particularly in the absence of compelling macroeconomic data points? Some observers point to the recent launch of Stock Connect, a new platform making it possible to trade directly in China shares from Hong Kong. Stock Connect is part of a larger effort on the part of Chinese financial policymakers to broaden participation in the country’s equity markets. Up to now it has been difficult for most investors to directly access China shares, particularly the closely restricted domestic A Shares leaving mutual funds or ETFs as the default vehicle of choice.

But Stock Connect alone is unlikely to be a sufficient explanation for such a powerful rally. The Financial Times reports today that retail brokerage account openings in China have tripled since May. A possible reason for this, the article notes, is diminishing confidence in other traditional investment types including bonds, real property and gold. Relatively modest valuations in many Chinese shares is another possible driver. Broad retail investor participation is also underscored by average daily trading volume some 5 times higher than long-term averages.

Bubble, Bubble, Toil and Trouble…

When any asset appreciates by nearly 50% over six months it is natural to wonder how much longer the good times can last. One potential red flag is an unusually large amount of net outflows from China ETFs. The South China Morning Post notes in an article today that the CSOP FTSE China A50 ETF, a vehicle for investing in China A Shares, saw net outflows of $845 million in the two weeks to the end of August, while outflows at a second FTSE A Shares ETF ran to $585 million last week (out of $9.7 billion in net asset value). Now, a partial explanation for the outflows may relate back to Stock Connect, with investors shifting out of ETFs and into direct investments in shares. But it may also reflect a lack of conviction that there is much gas left in this rally.

…Or More Room to Run?

That being said, it is by no means a given that shares in China are headed for a sharp drawdown. Historically, neither macroeconomics nor valuation metrics have much in the way of correlation with equity price trends. The Shanghai Composite has indeed been a relatively lackluster performer recently, and even after the current rally the index is off the five year high marks reached in 2010. While there may be more upside ahead, though, one could easily make the case that prudence argues on the side of waiting for a pullback or two before building up any long overlays in Chinese equities.