Here’s a fun little fact. According to the most recent Flow Show report issued by BofA Merrill Lynch, a whopping total of $576 billion flowed into global equity funds in the past five months, since November 2020. To put that number in perspective, it is larger than the $425 billion invested in equity funds for the entire twelve years prior to that. That’s right – more money in five months than in the previous 12 years combined. With all that money coursing through the arterial channels of the world’s capital markets, it is perhaps not so surprising that we have seen such follies in recent weeks as the GameStop circus, the stratospheric valuation multiples of companies like Tesla, and the blind zealotry in pursuit of whatever exactly it is that cryptocurrencies have to offer in the way of value. Or NFTs – non-fungible tokens – those Internet GIFs given the stamp of “authenticity” by blockchain that makes your Sail Cat clip unique from all the other Sail Cats that billions of people have already viewed and thus worth – tens of thousands, apparently. It’s Beeple’s world, and we’re just existing in it.

$40 Million on 25

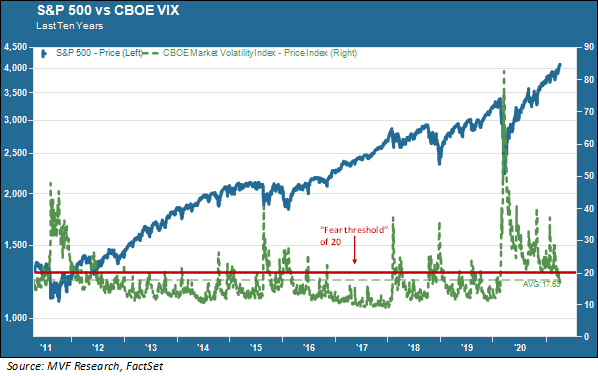

All melt-ups have their Cassandras foretelling gloom and doom ahead. This week a trader (or perhaps several traders together) put a $40 million bet on a complex options strategy that will pay off if the CBOE VIX index is above 25 by July. The VIX, no stranger to our weekly commentaries, is popularly known as the market’s “fear gauge”. Below is a chart showing the VIX along with the S&P 500 for the past ten years.

As the chart shows, the VIX tends to spike up during equity market selloffs. Each of those Alpine peaks corresponds to the periodic corrections we had in the stock market over the last ten years up to and including the pandemic. The market pullbacks were relatively brief during this period, and the VIX subsided each time accordingly, though it stayed above the level of 20 – widely regarded as the “fear threshold” – for nearly a full year after the Fed calmed things with its unprecedented flood of credit markets intervention last March.

Whoever put that $40 million down on the VIX going back above 25 by July (it currently is around 17) is betting on a sizable pullback in equities sometime between now and then. He or she or they have company (though perhaps not as audacious in putting their money where their mouth is). From fundamental valuation multiples to technical chart indicators to fuzzy “sentiment” gauges, the market is flashing a number of cautionary signs, and market pundits are taking note.

There (Still) Is No Alternative

Any bet on a short-term correction, though, should consider the larger picture. The global economy is set to grow for the next several quarters, at least, at levels not seen in decades. Companies will start to report sizable earnings rebounds when the Q1 earnings season commences next week (and Q2 should look particularly robust as the comparison period will be Q2 2020, when the peak effects of the pandemic lockdown were felt). A number of economists believe this economic growth cycle could be stronger than the last one (and that one, from 2009-20, was the longest on record).

And yes, there will probably be some inflation to go along with the growth. Wholesale prices were higher in March than economists had expected, with the core Producer Price Index (PPI) registering a year-on-year gain of 3.1 percent. China’s PPI grew 4.4 percent in March. Inflationary expectations have been the driver behind the recent pickup in intermediate and long-term bond yields. But the Fed, for its part, remains very calm about prices and does not plan to change its accommodative monetary stance if consumer prices start trending above its longstanding two percent target.

The basic fact remains that there are not a whole host of alternative choices for all that money that has flowed into equities. TINA – there is no alternative – has been a staple influencing factor in investment decisions since the Fed first started its unconventional quantitative easing programs early in the last decade. Share prices could certainly teeter in the coming weeks, and that $40 million options bet on volatility may well pay off (it could likewise wind up being $40 million down the drain). As with any pullback strategy, timing is everything – and in the end, timing is a fool’s errand.