Very few things are certain in times of economic downturn. One thing you can hang your hat on, though, is that market pundits will scour the contours of every letter of the English alphabet looking for the perfect visual symbol to align with their views on what the downturn-plus-recovery will look like. It seems that you cannot properly characterize an economic cycle without the prop of “[letter of choice]-shaped recovery” to underscore your thesis.

The Alphabet Song

Hope springs eternal for those who embrace the letter V, in which the good times come roaring back with all due speed. There tends to be an abundance of these folks in whatever presidential administration happens to exist at the time of the downturn, and they dominate online financial chat rooms. The letter U, on the other hand, suggests a more gradual, tempered period of adjustment before things get back to normal. This is a good look for furrowed-brow habitués of the “Meet the Press” or “Face the Nation” green room. Then there is W, for those whose memories stretch back to the “double dip” recession of 1980-81. Last – but by no means least in number — are the gloomy Cassandras holding aloft the letter L, implying that it’s not even worthwhile to look for signs of a recovery as far as the eye can see.

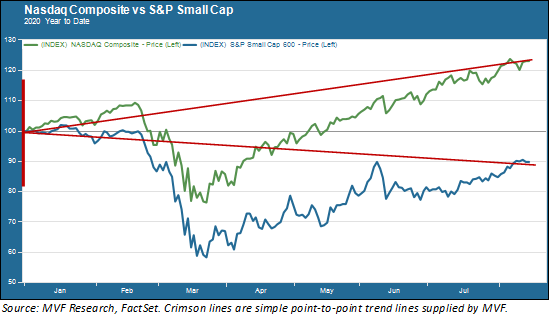

The recession of 2020 has introduced a new letter to the usual mix. This recovery has produced the baffling contradiction of a soaring equity market alongside the worst headline economic numbers since the Great Depression. But there is a letter for that! Squint hard at the two price lines below and see if you can identify a childish scrawl of the letter K. We have helped illustrate by providing point-to-point directional trends (in crimson).

We’ve covered this ground before: the recovery in the stock market has been uneven and highly in favor of the technology giants that dominate the Nasdaq Composite (shown in green). But there is a larger story here than just relative stock market trends, a story that gives substance to the notion of a “K-shaped recovery.” Think about small cap stocks. In the second quarter of this year the aggregate earnings of companies that make up small cap indexes like the S&P 600 (blue trend line above) and the Russell 2000 were negative. Small businesses on whole lost money. By comparison the combined earnings for the S&P 500 for the same period are in the range of $234 billion, even after suffering the disruptions of the pandemic. The outperformance of indexes heavily weighted by mega-cap tech companies is easier to understand in the context of a K-shaped recovery: the large have gotten larger and more successful, while the fortunes of the small have turned the other way.

The Case for Caution

This divergence of fortune is true out in the real world as well. The recession is already over for many of the more fortunate among us, whose jobs proved to be portable from office to home with minimal interruption and whose assets – notably stocks and real estate – are percolating along nicely. For a great many others, the recession is not only not over, it is getting measurably worse. Economic benefits from the CARES Act have expired, rents are overdue and the small businesses where they work are still shuttered. These people – at least 16 million of whom are still entirely out of work – are not the beneficiaries of surging prices for expensive leisure toys like boats and private planes (which businesses are very much on the upward trajectory of that K-shape).

Ultimately, though, luxury goods are a relatively small niche area of the economy. An overall, broad-based return to growth depends on more than high-end sales to the few who can afford them. And that recovery is threatened. It is threatened by the inaction in Congress which appears set to spill into the August recess and then the intransigence of what will assuredly be the bitterest of election seasons. It is threatened by the inability of millions of small and mid-sized businesses to regain their footing, rehire their employees and return to profitability. It is threatened by the persistence of the virus in the face of an abject failure of will, discipline and action at the level of a national strategy to deal with it.

All of which, in our opinion, calls for continued caution and resisting the siren song of FOMO. Stocks have had a good run, especially the large cap beneficiaries of the “big get bigger” trend. But in the end the upward-sloping arm of the K-shaped recovery needs its downward-sloping mirror image to morph into another shape. There are many structural headwinds in the way of that happening any time soon. We may see continued upside in this resilient rally, but there enough risks at play to maintain our commitment to protection on the downside.