Old hands on Wall Street have long ascribed distinct anthropomorphic characteristics to different asset markets. The stock market, they say, is the kid who sees a pile of straw under the Christmas tree and says “I know there must be a pony in the back yard!” The bond market is the old sourpuss who says “Kid, if your dad bought you a pony then he’s in debt up to his eyeballs and about to go bankrupt.” So it has gone this year. Stock markets have been relentlessly optimistic all the way through the worst health pandemic in more than a century, and by some measures the sharpest economic decline since the Great Depression. Fixed income investors, on the other hand, have looked on with a mix of bewilderment, disapproval and expectations of misplaced confidence on the part of their risk-seeking peers.

The Game Changer

Small wonder, then, that the long-awaited news of success in Phase 3 trials for a coronavirus vaccine sent a new shiver of delight into global equity markets. On back-to-back Mondays – November 9 and November 16 – two companies announced that their trials to date have resulted in efficacy rates greater than 90 percent. This is an almost-unheard of rate of success for a new vaccine. If the views of the world’s top immunology scientists are correct – and there is scant reason to think they are not – then it would seem likely that sometime before the end of next summer there will be a sufficient level of broad-based protection against the virus to facilitate a return to the things in life we have so sorely missed. In this particular case the sunny view of the equity market may rest on a solid foundation. That has the potential to be a real catalyst in shifting some long-standing market trends.

Hello, Small Caps

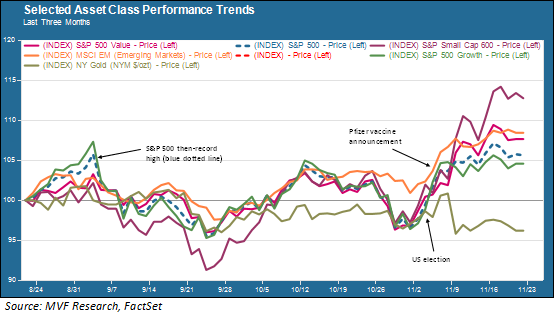

The chart below shows the performance of a handful of asset classes against the S&P 500 (represented by the blue dotted line) over the past three months.

As the chart shows, many asset classes did little more than tread water between peaking in early September after a torrid summer rally and the approach to the presidential election earlier this month. The election results brought a certain amount of clarity that took some of that pressure off risk assets, and that was followed a few days later by the vaccine news.

As you can see from the chart, the market reaction was most pronounced in some of the areas that have been long-term underperformers. Small cap stocks, in particular, have leapt ahead of the pack in the time since the election (the crimson trend line). Value stocks and emerging markets, two other habitual underperformers in recent years, have also outpaced the S&P 500. Meanwhile investors have been bailing out of gold, one of the leading “haven” assets during the pandemic.

How Durable the Rotation?

What is not entirely clear at this point is if this “vaccine trade,” for want of a better name, is really anything more than just a reflexive expression of risk-on sentiment that snaps up undervalued assets in the expectation that a rising tide will lift everyone. It may well be nothing more than that – but even that simple narrative might be enough to keep the small cap and value stock party going for a while. We are talking literally years since these asset classes have outperformed the Big Tech darlings that make up a quarter of the total market cap of the S&P 500 and an even bigger share of the S&P 500 growth index and the Nasdaq composite. Their valuations, while still supported by above-average expectations for sales and earnings growth, remain exceedingly high. A rotation play driven by an overall economic message of return to health may be durable – even if the recovery still won’t come quickly enough to remedy the extreme effects the health crisis will exert on our system in the coming several months.

As for emerging markets – the other relative outperformer of late – bear in mind our comments in this space a couple weeks back about China and the Asia Pacific region. The world’s second-largest economy is already back in growth mode, while the region itself is in the process of forming a trade alliance that will rival the EU and North America in its economic heft. There are reasons beyond asset rotation considerations from taking that part of the world very seriously. We have much to do in preparing for the right positioning in 2021.