The headline number was underwhelming. Today’s quarterly release by the Bureau of Economic Analysis showed real US GDP growing at a rate of 1.2 percent for the second quarter of this year – less than half the 2.5 percent clip projected by analysts. Moreover, the already tepid first quarter growth rate was revised down to 0.8 percent, putting the total average growth rate for 2016 to date at about half the pace of the past four years. Right on cue, Fed funds futures markets tossed out the string of recent upside macroeconomic surprises – from wages and job growth to retail sales and capacity utilization – and lowered the probability of a 2016 rate hike to below 40 percent. Below the headlines, though, there appears relatively little about which to be concerned in the short run. The S&P 500 appears to have opened its eyes, digested the GDP data, shrugged and turned over on its beach towel to get an even tan.

Seventy Percent Okay

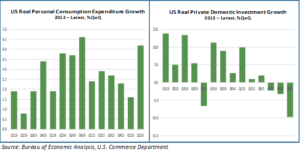

Consumer spending accounts for roughly seventy percent of our GDP, and by this important yardstick the quarter would appear just fine, thank you. The chart below shows the recent trend in consumer spending next to that of private domestic investment – i.e., what private sector enterprises invested into growing their businesses. The contrast is clear: brisk consumer activity alongside a lackluster pace of business capital outlays.

Below the headline number, in fact, GDP activity looks quite consistent with other recent data, notably wages and prices. With wages and inflation ticking up in recent months, it is not surprising to see consumer spending moving along at a respectable pace. On the other side, the fact that business spending dropped by 9.7 percent this quarter, notching a third consecutive quarter of declines, is probably less of a cause for concern than the magnitude of the number may suggest. The two big losers in the category were structures (minus 7.9 percent) and equipment (minus 3.5 percent). These were attributable in no small part to the sharp reduction in capital expenditures by companies in the energy, mining and other resources sectors. In other words, the reversal in business spending likely contains a much more cyclical than secular component, which should stabilize along with oil and other commodities prices.

Long Term Remains Murky

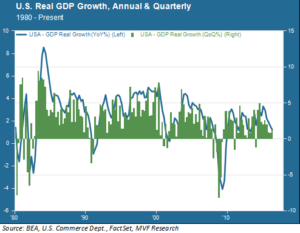

Our relatively benign interpretation of the Q2 GDP release, though, does not change the considerably murkier set of circumstances surrounding long term growth trends. The fact remains that the pace of recovery from the worst economic pullback since the Great Depression has been far below historical norms. The chart below shows the pace of overall real GDP growth from 1980 to the present.

A deep recession more often than not is followed by a sharp recovery off the trough; consider the pace of recovery following the painful double-dip recession of 1980-81 and even those following the comparatively mild recessions of 1990-91 and 2001-02. Not only was the post-2008 off-trough recovery weaker than these previous cases but, as the chart clearly shows, the average growth rate throughout the ensuing seven years has been well below trend. Weak growth is an outcome of a persistently diminished rate of productivity, a trend with no clear causal factors that continues to perplex economists.

Janet Yellen’s Tea Leaves

Whether or not today’s Q2 GDP release moves the needle one way or the other on the Fed’s policy dashboard remains to be seen. The press release following this week’s FOMC meeting was a bit more upbeat than the previous one, though – as has become customary – the language appeared more reactive to asset market conditions than anything else. We translated the press release’s phrase “Near term risks to the economic outlook have diminished” to read thus: “Brexit happened and stock markets didn’t implode, so we feel okay.” A healthy pace of consumer spending alongside a short cycle of reduced business spending shouldn’t get in the way of any plans for a rate hike. But in the end it is likely to matter much less than some other random event, somewhere in the world, sparking another technical correction in the stock market.