One of the great debates among the economic literati in recent years has been whether the subpar growth trends of late are cyclical or more long term in nature. The bearish long term view goes by the name “secular stagnation,” with advocates including former Treasury secretary Lawrence Summers making the case for a world stuck in a rut of anemic capital investment and lackluster demand. Two years ago, secular stagnation seemed like a pretty good theory to explain the deflation trap threatening to ensnare the Eurozone, zero-bound interest rates in the US, and many former growth darlings in emerging markets falling into low single digit or negative growth.

Macro headlines today tell a rather different story. In the US jobs, wages, prices and consumer confidence are all trending uniformly higher, as indicated in the chart below.

Meanwhile, Eurozone inflation has bounced back and even Japan is enjoying a relatively unusual run of positive growth. Most Asian economies are performing decently, if not necessarily spectacularly, while erstwhile basket cases Brazil and Russia seem to have gotten through the worst of their travails. Is it time to put a fork in the secular stagnation theory and call it done? Asset markets certainly seem to think so; today’s valuation levels can only appear reasonable if premised on the imminent resumption of historical-trend growth. But before we read last rites and sing Psalm 23 over the corpse of secular stagnation, we need to supply an answer to the question of what forces are present to drive that historical-trend growth.

1938 Calling

The term “secular stagnation” is not new; it was coined in 1938 by prominent US economist Alvin Hansen. If you are familiar with US economic history you will recall that 1938 was the trough year of the second sharp pullback of the Great Depression: not as deep as the earlier one that bottomed out in 1932 but still painful, with unemployment at 20 percent and a steep decline in US population growth. Hansen looked around him and saw no way out; the world was locked into that dreaded feedback loop where businesses invest less because they expect continued lower demand, and households spend less because there are fewer jobs. Secular stagnation, in other words.

As we know now, of course, the world didn’t turn out that way at all. Instead, the onset of the Second World War unleashed a torrent of economic growth to supply the war effort, and after the war the US, as the sole economic superpower, ushered in a glorious thirty year period of steady and sustainable growth. The secular stagnation theory was laid to rest, until its resurrection by Larry Summers et al in the 2010s.

Attractive Economy Seeks Feisty Catalyst for Growth, Good Times

The headline economic data shown in the chart above are promising, but they are not yet sufficient to return secular stagnation to the box where it rested from 1939 to 2010. While the circumstances that produced the magnificent growth from the late 1940s to the early 1970s are complex and varied, the growth drivers themselves are easy to pinpoint. First, a return to population growth after the anomalous decline of the Depression years. Second, growth in labor force participation as returning war veterans went into a booming job market (and were later joined by a rising level of participation by women). Finally – and most importantly – was growth in productivity, or efficiency gains in how much output businesses could produce for each hour worked.

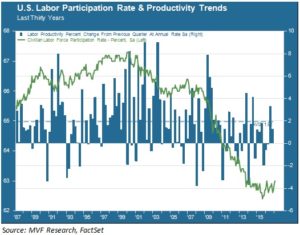

Are we on the cusp of another productivity boom? The data do not yet point to one. The chart below shows US productivity trends, along with the labor force participation rate, for the last thirty years. Both of these growth indicators remain decisively below-trend.

Some argue that the innovations of recent years will be that much-sought catalyst desired by the global economy. Expansive pundits talk of the Holy Trinity of the Three Industrial Revolutions: the steam engine of the late 18th century, electricity and the internal combustion engine a century later, and the smartphone in the early 21st century. Perhaps history does move in such well-tempered cycles; alternatively, perhaps the culture of growth that grew up around the first two Industrial Revolutions will be seen by future historians as a delightful anomaly rather than an inevitable forward march of progress. Time will tell whether this third iteration can deliver the goods.