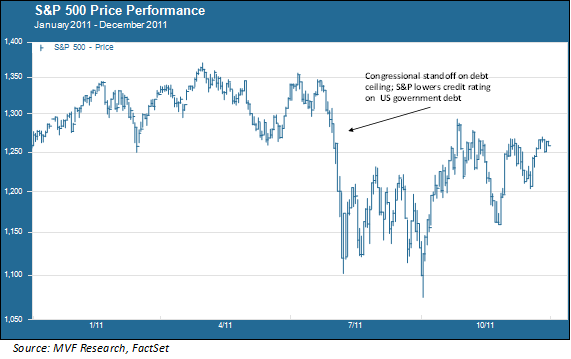

Ten years ago, markets got a nasty shock when the normally routine act of raising the debt ceiling got roped into the bitter world of Congressional partisan gamesmanship. Then-president Obama tried and failed to cut a deal with then-House Speaker John Boehner. Standard & Poor’s, unimpressed by the devil-may-care shenanigans playing out in Congress, cut its credit rating on US Treasury obligations from their longstanding triple-A perch. The stock market was even less impressed and plunged nearly 20 percent before the dueling parties finally cobbled together an agreement.

In the wake of this near-disaster the belligerents sobered up, put aside partisan differences and vowed to never again play with fire where it concerns the full faith and credit of the United States government, right? Haha, if only. Ten years after that late-summer debacle in 2011 here we are again. In a sternly worded letter to Congress this week Treasury Secretary Janet Yellen said that the government will run out of money by the middle of October, sooner than expected, and that Congress needs to act pronto. Congressional Republicans united behind Senate Minority Leader Mitch McConnell to say – don’t expect any help from us. To which President Biden’s reply appears to be: I call your bluff and raise the stakes by forcing a vote on the debt ceiling. Go ahead and crater the economy, I double-dog dare you!

We’ve Already Spent the Money

With all the hyped-up performative bloviating about the debt ceiling filling up cable news hours, it’s easy to forget a simple fact: raising the debt ceiling is something we do to pay for things we’ve already spent money on. Raising the debt limit covers past obligations, not future ones. That’s what makes the stakes so high – if the world’s richest country becomes a deadbeat on paying its debts, things can go south very quickly throughout the entire economy. Not to mention the inability for the government to continue funding all the programs out there supporting pandemic relief, Social Security, defense and other critical areas (including the salaries of the people who work in the federal government).

Tough Days for Joe

So how do we keep this clown car from going over the cliff? The legislative environment is looking particularly challenging for the party in power, with razor-thin majorities in the House and Senate. In addition to the matter of resolving the debt ceiling, the Biden administration is trying to figure out how to pass the bipartisan infrastructure deal already approved in the Senate (with 19 Republicans joining the Democrats in a rare show of comity) along with a much larger (for now, anyway) bill packed with a variety of programs dealing with education, child care, climate change and other things the administration likes to call “social infrastructure.” There is a self-imposed deadline of September 26 for figuring out how to get both of these bills passed, but very little seems to have been done to resolve a massive gulf between the expectations of progressives and moderates within the Democratic Party (no support whatsoever is expected from Republicans on the social infrastructure bill, which currently has a price tag of $3.5 trillion and would involves some form of tax increases that are anathema to the GOP).

One way to resolve the debt ceiling problem would be to simply toss it into the social infrastructure bill and pass that through the reconciliation process that would avoid a Republican filibuster. But given the high level of uncertainty around that bill’s ultimate fate, Biden’s decision to keep the debt ceiling separate and require a clean, up-or-down vote on it in Congress (most likely in the form of a continuing resolution to fund the government) is probably the better option. That still leaves open the risk that Republicans stare down the administration’s dare and refuse to budge.

But – assuming that all House and Senate Democrats would vote in favor of the resolution – the Senate Republicans would actually have to use their filibuster weapon in favor of a move that would, with very high likelihood, send financial markets into a tailspin. It’s more likely that heavy pressure from the GOP’s copious network of supporters and donors from the business and financial communities would force them to back down – or at least the ten of them that would be needed to head off a filibuster.

We are of the opinion that a resolution on the debt ceiling, in one form or another, is the more likely outcome (though there are attendant questions about whether it would be just a short-term fix or a more stable resolution that would take the issue off the table for at least a couple years). Even so, though, the uncertainty is not helpful in an environment where there is already enough negative sentiment on other issues, from the persistence of the Covid delta variant to questions about the Fed’s timing for tapering its bond-buying program to the above-trend inflation rates in the US, Europe and China. It would be nice to get the debt ceiling issue fixed sooner rather than later – but we’re not holding our breath.