It’s pretty calm out there in market-land, an outcome consistent with our assessment of the current state of things in a commentary several weeks back. The stock market has made steady, incremental gains most weeks since early October on a combination of the usual driving forces: de-escalation of hostile rhetoric in the US-China trade war, earnings reports that, while hardly impressive, seem to be less bad than expected, fading fears of an imminent recession and the ever-dovish central banks on standby with their money faucets. Stocks have rallied even in the face of a significant back-up in bond yields, with the 10-year Treasury bouncing off an early October low of 1.5 percent to a recent high of just under two percent (in a more conventional world, bond yields and stock prices rising in tandem would not be all that unusual, but we no longer live in that conventional world, so the recent movement is notable).

Back to the Valley?

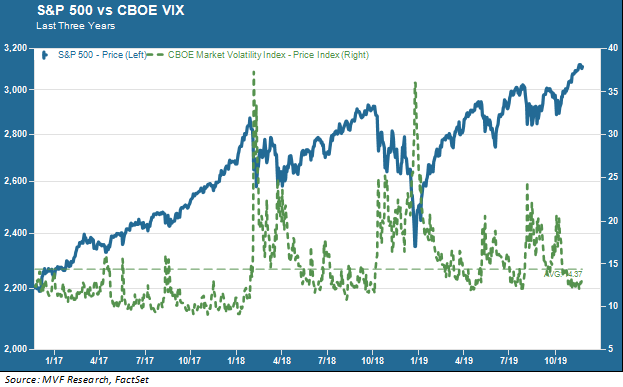

Risk, too, has settled down. The CBOE VIX, an index that measures market volatility, is trading near its lowest levels for the year to date. The chart below shows the VIX trend along with the S&P 500 for the last three years.

The VIX (the dotted green line in the chart) is popularly known as the market’s “fear gauge,” with those periodic Alpine peaks signifying moments of heightened fear. For much of this year the overall sentiment has been uneasy, with a couple pullbacks of more than five percent in the stock market keeping investor nerves on edge. However, there is a growing chorus of voices opining that the likely path of the VIX from its present level will be lower – a return towards the low-risk valley that prevailed for most of 2017. The thinking behind that, of course, tracks what we noted in our opening paragraph: if the big fear items (trade war, recession) are more or less off the table, then it’s all systems go for another year of TINA (There Is No Alternative) in large cap US stocks. Sure, there’s an election of some degree of importance next year, not to mention heightened political uncertainties in the broader world at large, but the stock market has become very adept at tuning out anything not directly related to the economy, trade tensions or central banks. If all that holds, continues this thinking, then 2020 could look more like that gentle bull of 2017 (low risk, high returns) than the more fraught years since.

Burning Down the House

We do not ascribe a high-probability likelihood to the gentle, low-risk outcome imagined by that thought process, and point to that above chart to remind you that risk reversals, when they happen, can be red and raw in tooth and claw. Ask anyone who was on the short side of the VIX in February 2018. Shorting the VIX is akin to selling an insurance policy. If you sell, say, a fire insurance policy to someone then you make money as long as that person’s house doesn’t burn down. Before the sharp stock market correction of February 2018, VIX traders were falling all over themselves selling the contract short, increasingly convinced the house would never burn down. When the VIX shot up over 37 on February 5, the carnage was so bad that several exchange-traded products set up to systematically bet against volatility collapsed (and in so doing amplified the market chaos). The house burned down.

Fast forward to the present. There is a record number of 204,000 contracts this week, according to the Commodity Futures Trading Commission, that represent short positions on the VIX. Most of these are owned by hedge funds, meaning that a meaningful plurality of the “smart money” out there sees the current Easy Street environment continuing along as far as the eye can see. What could possibly go wrong?