It’s earnings season again, and this one is likely to be a doozy. Companies reporting their results for the second calendar quarter of 2020 will get to show us how they have held up during a three month period that involved a dramatic lockdown, a furious scramble to reopen key economic sectors, and a realization (late in the quarter) that the coronavirus pandemic, far from being over, was scaling up to new heights. How is that all going to play out in the numbers? More importantly, what (if anything) are management teams going to tell us about how they see the next twelve months evolving?

Flatlining

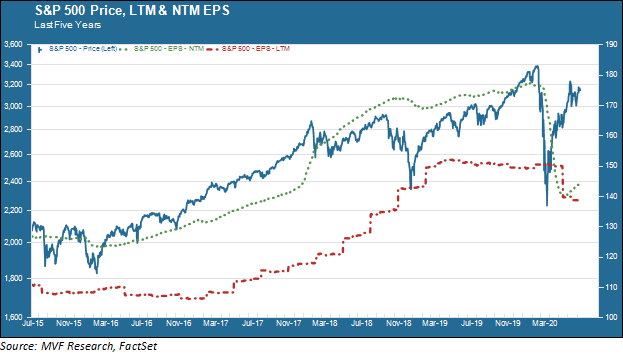

The truth about corporate earnings is that they were not growing very fast even before the pandemic hit. The chart below shows the trend of both actual and forecasted earnings for the past five years, along with the S&P 500 price trend. As you can see, actual earnings for the twelve trailing months (the crimson-colored dotted line) stalled out in early 2019, even as stock prices continued to rally.

It seems like forever-ago, but the global economy was no bed of roses in 2019. Europe was flirting with recession, China was resorting to old infrastructure tricks to prop up its published GDP numbers and the UK was teetering on the edge of a hard Brexit. Here at home the Fed threw in the towel on trying to bring interest rates closer to normal levels. The specter of a trade war hung over the world like the sword of Damocles. A brief inversion in the 2-10 year range of the yield curve in early September had many fearing an imminent recession.

Over the course of many analyst earnings calls, management teams expressed caution on prospects for both top-line growth and profit margins. The message seemed to sink in. The analyst earnings forecasts (the green dotted line in the above chart) started to temper somewhat from their normally rosy projections. Not that any of this mattered for stock prices, which continued to blithely sail upwards through all manner of negative news.

Along Came Covid

The arrival of the pandemic in March accomplished something almost never seen in earnings-land: the reversal of the usual gap between actual earnings and forecasts. That gap is the result of the theatrics analysts and management teams play with each other: analysts predict the best of all worlds twelve months from now (which is what the green line represents) and then slowly bring their estimates closer to reality as the date approaches. Typically this results in a “positive surprise” when the actual earnings number comes in slightly ahead of the final estimate. The stock price goes up, everyone is happy, rinse and repeat.

But when the economy went into lockdown it became clear that for at least two quarters earnings would be dismal. Analysts revised their forecasts sharply downward. You can see that in the chart where the green dotted line resembles a double-black diamond ski slope.

But even while the forward estimates were cascading downward the twelve trailing months trend (the crimson line) stayed right about where it was…until the first batch of reports came in for first quarter earnings in late April and early May. By the time most of the Q1 results were in, forecasted earnings and twelve trailing month earnings were just about equal to each other – a true rarity.

In the Long Run, Earnings Matter

This chart will start to look dramatically different as the second quarter season gets under way. For one thing, that crimson line will start to go down dramatically. The current analyst consensus is for Q2 earnings to decline by around 21 percent from where they were a year ago. The energy and consumer discretionary sectors are expected to decline by tripled digits. Even the high-flying technology sector, where valuations are already busting through the stratosphere and escaping gravity altogether, is predicted to decline by around ten percent.

The big question is what comes next. You can already see that green forecast trend line ticking upwards, suggesting that analysts are pricing in a rapid rebound in earnings fortunes at least by the fourth quarter, if not sooner. But the US economic outlook is changing by the day, and not for the better. So far, investors have resolutely pushed through every bit of evidence to the contrary in the expectation that earnings and economic growth will soar to the heavens after the March-April lockdown. It is always possible to ignore the hard numbers…for a while. But in the long run earnings matter. In the long run a stock price really is nothing more than a single number representing expected future cash flows. Until that crimson line representing actual earnings starts to trend upwards again, this market would seem to be well ahead of its underlying value. At some point that will actually be important.