Some summers are quiet. This is not one of those summers. One month ago, a hitherto dull and dreary political contest supercharged into a must-see roller coaster of events. Two weeks ago, a benevolent inflation report sent securities markets into a tizzy, producing dramatic rotations in and out of asset classes in both equities and fixed income. So here we are, as July heads to a close, not expecting that August will offer much in the way of opportunity for a quiet repose at the beach. It’s at times like this that we like to remember what the dormouse said to Alice: Keep your head. It can be hard to resist the impulse to act when there is so much going on every day. But these are the times, more than any, that call for discipline, patience and care in the management of portfolios with long-term objectives.

A Benevolent Economy

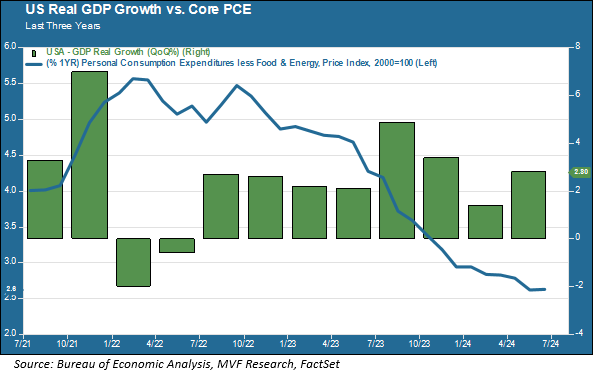

Let’s start with the economy, because here is where things are actually relatively steady. We got two new pieces of data this week. Second quarter real GDP growth came in higher than expected, at 2.8 percent (quarter-to-quarter, annualized). Then, this morning, the Personal Consumption Expenditures (PCE) report showed core inflation growing by 0.2 percent in June, translating to a 2.6 percent increase year-on-year, a cooling trend roughly in line with economists’ expectations.

Economic growth was driven by consumer spending and nonresidential private investment, while the cooling inflation trend suggests that the continued brisk pace of economic activity is not pushing prices up unduly. Importantly, the trend of the past several months has validated the view that moderating growth will not turn into stagflation, which some had feared earlier this year following a series of hotter than expected inflation reports.

Meanwhile, roughly 40 percent of S&P 500 companies have reported second quarter sales and earnings results, and the current growth rate (combining actual figures for companies already reporting and estimates for those still on tap) for earnings per share is 9.8 percent, higher than the 9.0 percent consensus forecast when the second quarter began. Although we still hear the term “macro uncertainty” peppered throughout the analyst calls with management, the uncertainty seems to be somewhat less forbidding than it was several months ago.

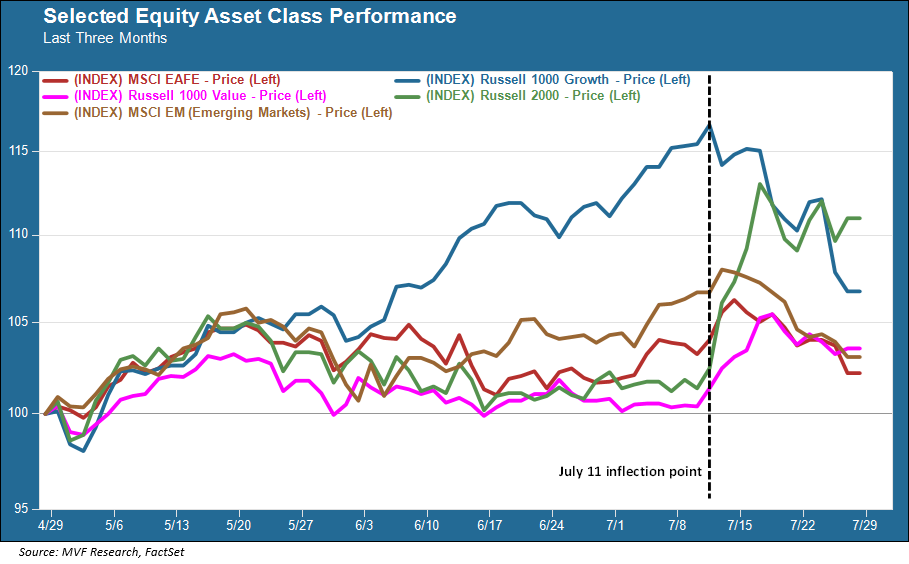

The Performance Bar Is Ever Higher

All that good news might lead one to believe that markets would keep on with the pleasant, gently upward vibe we saw throughout the second quarter. No such luck. As we noted in our commentary two weeks ago, investors seemed to be waiting for a catalyst to reappraise their positions in the expensive trades that had been hitherto been working so well, namely Big Tech and the AI narrative. They got the signal from that week’s CPI report, combined it with a newfound conviction that Republicans were going to sweep the electoral contests in November, and off to the repositioning races they went. Interestingly, though, while the initial rotations were into a variety of sectors from small caps to value to non-US equities, so far the only one with staying power is US small caps, as shown in the chart below.

What does all this mean? We’re not sure how much of that July 11 catalyst was actually related to the political outlook, though of course the financial media can never resist the opportunity to say “Trump trade” as a lazy shorthand to describe things. On the political front quite a bit has happened since then, and quite a bit more is likely to happen between now and November, so our advice, as always, is to tune out the noise. There is definitely a high bar for corporate earnings performance in tech and related sectors, as Alphabet (Google) can attest to following a fairly strong Q2 report this past Tuesday that investors greeted with a five percent hit to the company’s stock price.

We don’t expect investors to be any more forgiving when other tech heavy hitters report over the next couple weeks. That being said, we remain unconvinced that there is real structural sustainability to the current small cap rotation, and with the big moves that have already taken place, we think any meaningful tactical moves in this area would be ill-advised. There will likely be reversions to the reversions. But there will also be important strategic decisions to countenance in the not too distant future.