Covid, climate, cyber…of the big three scourges currently stalking the globe, Europe was at least spared this week of any known large-scale cyberterrorist attack. It was a bad week regarding the other two, however. The delta variant continues its ruthless stalking of a population still having trouble reaching its vaccination targets. If last Sunday’s UEFA championship match in Wembley Stadium, overflowing with more than 60,000 humans frenetically cheering on Italy or England, turns out to be the superspreader event many expect then the Covid numbers are likely to be even worse in the weeks ahead. Meanwhile a devastating climate event has left Germany with massive economic damage from flooding and a death toll already surpassing 100, with hundreds more missing and more rains expected in the days ahead.

Recovery, Interrupted

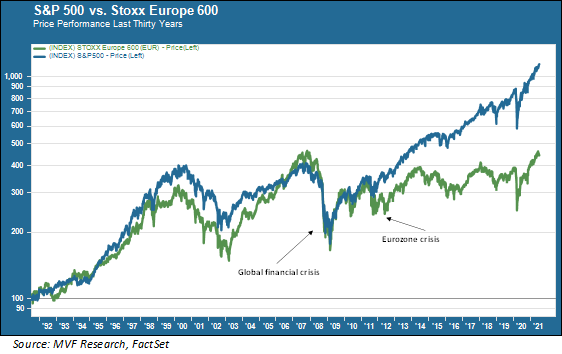

Europe started the year as an object of desire for global investors – a rather rare state of being for a region that has chronically underperformed US equities over a very long time. The chart below shows the relative performance of the Stoxx Euro 600, a regionwide benchmark equity index, against the S&P 500 for the past 30 years. Over this time the US index retuned more than double the level of its European counterpart.

This chronic record of underperformance, exacerbated by Europe’s prolonged financial crisis during the first half of the 2010s, left shares of many of the region’s best companies significantly undervalued relative to their high-flying US peers. As 2021 got underway many investors saw this as an opportunity: cheap, high-quality stocks on the cusp of a robust economic recovery, with a potential added boost coming from an appreciating euro against the US dollar. Regional bourses like the German DAX outperformed the S&P 500 during the first couple months of the year.

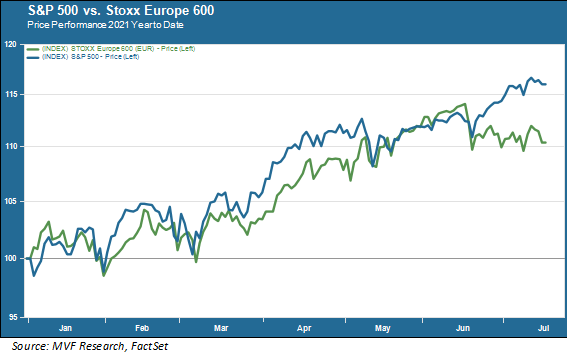

But the region’s botched handling of the initial vaccine distribution process, the persistence of high daily case rates for Covid and a euro rally that failed to materialize all contributed to throwing a wet blanket on the Euroequities revival party. A return to lockdowns of varying degrees of severity occurred across much of the continent. High-end industrial production, which is a much bigger component of Europe’s economic output than is the case in the US, flagged as some of its key export markets had to deal with their own ongoing Covid battles. Since the middle of last month US and European stocks have sharply diverged, as seen in the chart below.

Tech Envy

One of the prominent differences between benchmark indexes for US and European stocks is the much smaller percentage of technology companies in the latter. Technology shares comprise just 7.2 percent of the Stoxx Euro 600. The S&P 500’s technology sector – along with Alphabet, Facebook, Amazon, Netflix and Tesla (which are in other sectors but commonly thought of as tech companies) makes up about 46 percent of that benchmark’s total market capitalization.

That difference matters in many ways, not least of which is that in the US the megacap tech platforms have become something of a safety valve – a defensive play in some ways not unlike what sectors like utilities or defense manufacturers have traditionally been. In the past month or so these companies have accounted for almost half of the total price performance of the S&P 500. It is thus not unduly surprising that European markets have been unable to keep up over this time period.

Is Europe still a good bet? There should still be some upside to the recovery story as the more draconian social distancing measures come to an end. The region is likely to experience less inflation in the months ahead than the US, to the extent that trend stays in focus. But that long-term price performance chart is sobering. Perhaps the US will not be able to outperform Europe indefinitely. But figuring out when the mean reversion kicks in is likely to be a thorny problem.