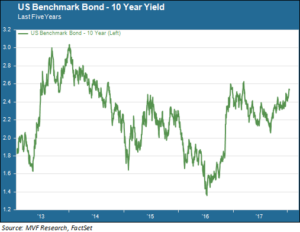

The S&P 500 has appreciated 3.6 percent in price terms in the first eight days of trading this year. It seems highly unlikely that the index will match this pace for the year’s remaining 242 trading days, so it’s reasonable to wonder what’s going to happen next. It’s always a fool’s errand to predict the timing and magnitude of future price movements; for clues, though, one’s best bet would probably be to follow the bond market. Amid all the exuberance in equities, there is a palpable edginess in the once staid world of fixed income. That edginess was on full display for a few hours Wednesday morning. A rumor floated out that China’s monetary authorities (who also happen to be the world’s principal consumers of US Treasury debt) were considering scaling back their purchases of US sovereigns, presumably as a cautionary move to diversify the composition of their foreign exchange reserves. Bond yields spiked immediately, and the 10-year yield shot up perilously close to last year’s high mark of 2.63 percent. That’s also the 10-year’s peak yield since the crazy days of 2013’s “taper tantrum” – remember those good times? The chart below shows the 10-year yield trend over the past five years.

At the Mercy of Supply and Demand

Wednesday’s mini-panic dissipated soon enough; the 10-year yield fell back and remains, as we close out the week, around 5 to 8 basis points below that 2.63 percent threshold (a handful of bond pros out there believe markets will all go haywire if that threshold is breached, for reasons with which we don’t necessarily agree). The Chinese put out an anodyne denial of any intentions to scale back Treasury purchases. The S&P 500, which Wednesday morning futures indicated could suffer a meaningful pullback, briskly resumed its winning ways. And all the while volatility has remained in the fetal position which has been its custom for the last year.

But that hair-trigger reaction to the China rumor underscored just how antsy the bond market is right now, and how exposed it is to the basic laws of supply and demand. Bear in mind that intermediate and long term bond prices are subject to many variables, while short term bonds tend to much more closely track the Fed. One of the key drivers keeping yields in check for the past several years has been robust demand from overseas – robust enough to make up for the reduction in demand at home when the Fed ended its quantitative easing program. If international investors turn sour on US credit – for whatever reason, be it inflationary concerns, a bearish outlook on the dollar or even jitters over our chaotic politics – that has the potential to push yields well past the notional 2.63 percent ceiling. A subsequent move towards 3 percent would not be out of the question.

Visions of 1994 Dancing In Their Heads

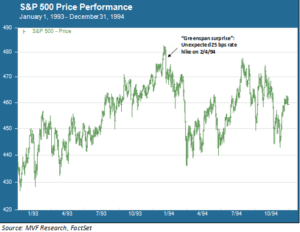

The bond market angst has its own mantra: “Remember 1994!” That, of course, was the year the Greenspan Fed surprised the markets with an unexpectedly aggressive interest rate policy, starting with a rate hike nobody was anticipating in February of that year. Investors will remember 1994 as being a particularly roller-coaster one for stocks, as the surprise rate hikes caught an ebullient bull market off guard. The chart below illustrates the volatile peaks and valleys experienced by the S&P 500 that year.

Now, the conventional wisdom in 2018 is that the Fed will do its utmost to avoid the kind of surprises the Greenspan Fed engineered over the course of 1994 (which included a surprise 50 basis point hike in the middle of the year). But investors are also cognizant of the reality that there are new faces populating the Open Market Commission, which of course will feature a new chair in the person of Jerome Powell. All else being equal, the new Fed is likely to proceed cautiously and not risk unnerving markets with a policy surprise. But all else may not be equal, particularly if we get that inflationary surprise we’ve been discussing in a number of these weekly commentaries. Then, a new Fed trying to get its sea legs may face the urgency of making decisions amid a tempest not of its own making.

We’ve had some reasonably benign price numbers come out this week: core producer and consumer prices largely within expectations. Bond investors appear relieved – yields have been fairly muted yesterday and today even while equities keep up their frenetic go-go dance routine. But there is not much complacency behind the surface calm.