“Money never sleeps, pal” said Gordon Gekko to his young protégé Bud Fox in the 1987 hit movie Wall Street. That sentiment rings ever more true nearly 30 years later; money not only never sleeps, but it races around in a hyper-caffeinated 24/7 frenzy from time zone to time zone, trading platform to trading platform, algorithm to algorithm.

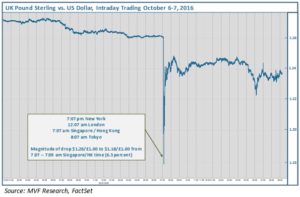

Last evening around 7pm Eastern time, as Wall Streeters piled into their favorite happy hour watering holes, latte-gulping currency pros in Singapore and Hong Kong watched an unnerving spectacle unfold in the early hours of their trading day. The British pound sterling had been under pressure all week, slipping from $1.30 on Monday to what seemed to be a support level around $1.26 on Thursday. Just after 7:00 am Singapore/Hong Kong time, that support level crumbled and the pound plunged more than 6 percent in the space of two minutes to a low of $1.18. The chart below illustrates the suddenness and the severity of the latest addition to the annals of “flash crashes.”

Algorithm, J’accuse

As of this writing, trading authorities in Asia (where most trading in the pound at the time was taking place) and London maintain they have not pinpointed the cause of the flash crash. Sporadic volume and a multiplicity of private, proprietary trading platforms may make it difficult to identify the cause of the price spasm. It is possible the problem originated with one of those unfortunately-named “fat finger” trades – market jargon for a data input mistake in the volume or price of an order. At some point – traders on the scene seem to be pointing to when the price moved below $1.24 – it would appear plausible to lay blame on those algorithms primed to pull the trigger at certain volatility thresholds. Algorithm-driven programs dominate intraday trading volumes across a wide swath of asset and derivative markets from currencies to equities, commodities and bonds. The laws of supply and demand dictate that, when a trigger price unleashes a flood of orders, seemingly irrational but very explainable volatility ensues.

Crisis à la Hollande-aise

Not everyone is ready to lay all the blame for this particular flash crash at the feet (such as they are) of the machines. As we noted above, the pound was under pressure in the days leading up to the event, notably along the contours of a hardening turn of sentiment regarding Brexit. UK Prime Minister Theresa May gave a tough talk at the Conservative Party conference this past week clearly aimed at a political, rather than a business, audience. While there is still a vast gulf of time between today and the beginning of Brexit negotiations next March, markets widely interpreted May’s words as indicative of a “hard Brexit” – more of a clean break with the Continent than a Norway-style preferred trade arrangement with a few compromises on contentious areas like immigration.

French President François Hollande added his own thoughts about “hard Brexit” Thursday evening. At a dinner with EU Commission President Jean-Claude Juncker, another hardliner on Brexit negotiations, Hollande stressed that a tough stance was crucial to the very survival of the EU’s fundamental principles. The main point about this speech was the timing of its publication in the Financial Times: a few minutes after 7 am Singapore/Hong Kong time, or M-minute for the flash crash. Programmers have long since mastered the art of translating the digital sentences of online news reports into 1s and 0s for their trading programs, so presumably the Hollande comments could have piled onto and inflamed the already-negative sentiment.

Welcome to the World of Event Risk

Whatever the make-up of factors involved in the pound’s flash crash, this much we know with a high degree of confidence. Asset markets today are driven by discrete events far more than they are by anything else. And technology facilitates the amplification of these events so that what might have been a price movement of one percent back in days of old can easily turn into an instantaneous gyration of five percent or more today. Those are the necessary facts of today’s capital markets.

Events stretch ahead through 2017 as far as the eye can see. Aside from Brexit, there are elections in Germany and especially France next year that could have a major impact on those “fundamental principles” of the EU – particularly if France’s far right Marine Le Pen outperforms. There will likely be reckonings aplenty at the OK Corrals of the Bank of Japan, the ECB and the Fed. And there are no doubt a handful of “unknown unknowns” about which nobody is talking now that will flash onto trading screens over the course of next year.

As last night’s flash crash instructs, a price movement that wildly overshoots the likely material impact of the event in question does correct itself in short order, which is why our default position on event outcomes is not to trade into them. That being said, though, there were plenty of trades executed within those two minutes of panic that reflected genuine investor sentiment on the value of the pound sterling. Is the investor who dumped a pile of sterling at $1.18 a sorry chump or a cold-eyed assessor of Britain’s post-EU future, waiting to cash in his chips at $1.10? The “if/else” logic of future events will supply the answer. The problem with the “1 or 0” outcome of these events, though, is that they make farcical work of predicting the odds.