Happy September! Now that the month is upon us, the kids back at school and the weekends filling up with tailgates or trail runs (or both, even better), it’s time to think about that possible rate hike a couple weeks away. Just kidding – we’re not thinking much about a September hike because we think that is well and truly baked into the cake already. We’re thinking more about that possible December hike, the year’s fourth, which is less fully priced into current asset markets but which we see as increasingly likely. Today’s job numbers add a resounding notch to our convictions.

Meet the New Data, Same As the Old Data

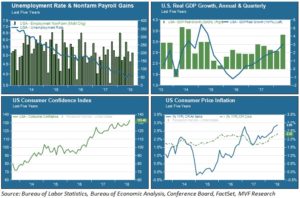

Sometimes it can seem like the world is changing in unimaginable ways every day. However, one just has to study macroeconomic trends over the past four-odd years to be reassured that, economically speaking at least, not much ever seems to change at all. We often use the chart below in client discussions to drive this point home: in terms of jobs, prices, sentiment and overall growth – the big headline data points – the story more or less remains the same.

In brief: monthly payroll gains have averaged 215,000 in 2018, including today’s release showing job creation of 201K in August (and also factoring in a downward revision to July’s numbers). Real GDP growth is above-trend, consumer confidence has not been higher for literally the entire millennium, and consumer prices are above the Fed’s 2 percent target for both core and headline readings. This composite view suggests a fundamentally stronger economy than the one we had in between the two recessions of the previous decade. What is inconsistent with this picture of strength is a Fed funds rate staying much longer at 2 percent. It was 2 percent at the end of 2004, on its way to a peak of 5.25 percent by the time that growth cycle peaked. With the caveat that nothing in life is ever certain, including economic data releases, the picture shown in the above chart tells us to plan on that fourth rate hike ringing out the old year come December.

Dollar Dolorosa

As the US rate scenario settles into conventional wisdom, there is plenty of upside room for the dollar (a rising rate environment, all else being equal, is a bullish indicator for the national currency). While the greenback has traded strongly against the euro and other major developed market currencies this year, at $1.15 to €1.00 it is far from its late 2016 peak when it tested euro parity.

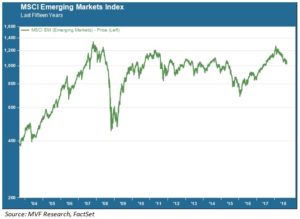

Where the dollar’s strength can do much more harm, though, is in emerging markets. Many of those currencies are at decades-long, if not all-time, lows versus the dollar already. The dollar is up 22 percent against the Brazilian real this year, and 12.6 percent versus the Indian rupee. If you hold emerging markets equities in your portfolio you are feeling this pain – when your equity price returns are translated from the local currency back into dollars you are directly exposed to those currency losses. For example, the MSCI Emerging Market index reached an all-time high in local currency terms back in February of this year. But in US dollar terms – shown in the chart below – the index has never recovered its pre-financial crisis peak reached in November 2007.

We’ve communicated our sentiments about emerging markets frequently on these pages – while important as an asset class given the size of these economies (and the wealth therein), emerging markets have underperformed domestic US stocks on both an absolute and risk adjusted basis over a very long time horizon. They enjoyed a sustained period of outperformance during the mid ‘00s in conjunction with the commodities supercycle – and again for about a year following the reversal of the ill-considered “Trump trade” fever after the 2016 election. During that latter growth spurt we elected to sit tight with our underweight position rather than try any fancy tactical footwork. We stand by that decision today.

We have yet to arrive at our conclusions for positioning in 2019, in EM or any other asset class. But from where we sit today the most convincing picture of the global landscape points to a continuation in the US up-cycle, with the attendant implications of a stronger dollar and further downside potential in other markets, particularly emerging ones. That does not necessarily imply blue skies ahead for US assets – there are some complicating factors at home as well, which will be themes for forthcoming commentaries. But we see little out there today arguing for a bigger move into emerging markets.