This year it seems that the old-timers on Wall Street have it at least partly right. “Sell in May, go away” goes the timeworn chestnut. Investors certainly have fulfilled the first part of that command. Barring some completely unexpected turnaround between now and the day after the holiday long weekend, the not-so-merry month of May will add another notch to the ever-growing calendar of 2022 loser months.

Whether folks go away or not is a more open question. Sentiment continues to be broadly negative. To cite a few examples, the bullish indicator in the Investors Intelligence report is below its pandemic trough in March 2020. A “Bull and Bear Indicator” put out by Bank of America is at a level the institution calls an “unambiguous contrarian buy” signal, which is similar to Goldman Sachs’s take in its Sentiment Indicator, which has been in oversold territory for five straight weeks for the first time since 2011.

No Bailouts Ahead

None of which is to say that the market is currently ripe for buying the dip in the way that every significant pullback since 2011 has witnessed. Those institutional bull-bear indicators may sound authoritative, but from a statistical validity standpoint they are pretty threadbare. There just aren’t that many bear markets to supply a plentiful sample size. In recent or sort-of-recent memory that would include the financial crisis of 2008 and the tech meltdown of 2000, plus the ever-so-brief technical bear of Pandemic 2020 and a few near misses in 2018, 2011, 1998 and 1990. But whatever. Sentiment is pessimistic, and at some point things will likely seem oversold to enough people to catalyze the dormant animal spirits.

We imagine that might have happened already except for the one thing that makes this pullback different from all other pullbacks since the financial crisis: this time, the Fed is very clearly not on hand to bail out holders of risk assets. The assurance of a liquidity infusion by the Fed, familiarly known as the “Fed put,” is not to be had when the central bank’s singular focus is on engineering a monetary tightening policy that will subdue inflation without sending the economy into recession. Fed chair Powell says this will be very difficult and involve pain. No Easy Street for the stock market in this formulation.

How Much More For Tech?

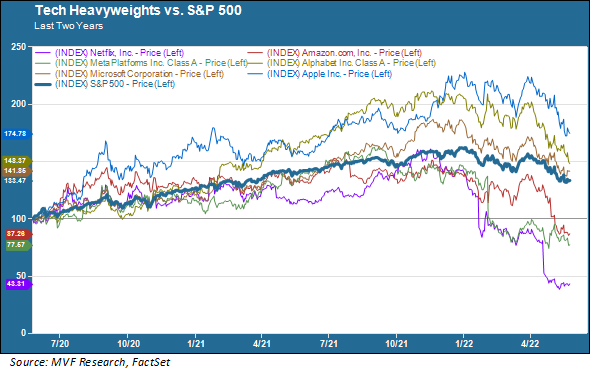

One way to think about when the selling might be due for a respite and turnaround is to ask how much more pain is likely to be in store for Big Tech. The likes of Apple, Microsoft, Facebook, Amazon, Netflix and their ilk provided much of the bulk in driving broader market indexes higher in the past few years, thanks to their outsize market capitalization – by some measures a third of the total market cap of the S&P 500 at their peaks, and an even higher percentage of growth-weighted indexes like the Nasdaq Composite and Russell 1000 Growth index.

That outsize impact has made itself equally felt on the way down. As the chart below shows, three of the erstwhile high-flyers (Amazon, Meta (Facebook) and Netflix) are trailing the overall S&P 500 on a two-year basis, while another two (Microsoft and Alphabet) are knocking at the door.

The pullback in tech has been broad-based, dragging down both the leaders in their respective business segments shown in the chart above and much less battle-tested wannabees with dicier cash flow growth prospects farther out in the future. Now, based on our simple understanding of the present-day economy, these tech heavyweights aren’t going anywhere anytime soon. The economy is increasingly digitalized. Technology is increasingly the determinative factor separating winners and losers in just about every imaginable industry sector. High inflation is not going to kill that trend; neither will a reversal of GDP growth if that does wind up happening sometime in the next couple years.

Market timing in general is a fool’s errand – this year has already supplied ample evidence of that in the form of, among other things, the war in Ukraine and the supply chain reverberations from Covid lockdowns in China. We imagine there will be more surprises ahead – and those may just as easily be of a positive as well as a negative variety from a market standpoint. But treating the relative fortunes of Big Tech as a leading indicator may not be the worst way to think about when it makes sense to start building up equity exposures again. There may be some opportunities this summer for those who stay to play.