Not too many people were paying much attention as the curtain raised on Act I of Greece’s financial drama. That was back in the fall of 2009. World equity markets were recovering from the Crash of 2008, and market pundits had weightier issues on their mind than the woes of a small equity market on the periphery of the European Union. Between October and December of that year Athex, the benchmark Greek stock index, fell a bit more than 22%. It didn’t’ stay off the radar screen for long. As is often the case, stock prices proved to be a leading indicator of deeper, more structural economic issues. As we know now, Act II of the Greek drama played out between 2010-12, bringing the entire Eurozone within a whisper of breaking up. Greece’s exit from the Union – the so-called “Grexit” – seemed to be a given. That this scenario did not play out is a testament to the power of words – specifically the three words uttered in June 2012 by ECB Chairman Mario Draghi that the central bank would do “whatever it takes” to maintain the integrity of the single currency region.

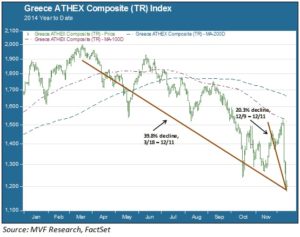

Fast forward to December 2014. Once again Athens is bucking the trend of a generally positive year for stocks, falling more than 20% in just the last three days. That adds up to a decline of nearly 40% from the 52-week high reached in March of this year. The chart below illustrates the carnage.

Snap to It

Share price movements don’t always have directly identifiable causes, but it’s fairly easy to point the finger at the culprit behind this week’s downward spiral. On Tuesday Greek prime minister Antonis Samaris announced a surprise snap election for the Greek presidency. The president is the head of state but serves largely as a figurehead, so one might think that a snap election is no big deal. But by calling for the election the government has opened up the possibility for a vote of no confidence that could lead directly to a general election – a very consequential outcome indeed. The ruling party – a coalition of Mr. Samaris’s center-right New Democracy Party and the socialist Pasok Party – has been more or less successful at keeping Greece on track with the terms of an austerity program agreed to in exchange for a bailout led by the so-called “troika” of the International Monetary Fund, European Central Bank and European Commission. The status quo would be in jeopardy, though, if the opposition Syriza Party were to prevail in a general election. Syriza, led by the charismatic and anti-austerity Alexis Tsipiris, won the largest block of seats for Greece in the European Parliament elections held earlier this year.

Mostly Quiet (for now) on the Periphery

For now, the damage appears to be largely contained within Greece itself. While benchmark borrowing costs in the country have soared to over 8%, sovereign debt in other peripheral countries such as Spain and Italy remains largely unchanged. Indeed, Spain’s 10 year benchmark bond currently yields 1.9%, less than the U.S. 10 year Treasury. The fear, of course, is that these low debt levels are unsustainable, and that Act III of Greece’s crisis will resemble Act II by spilling over Peloponnesian borders into neighboring lands. That would very likely force the hand of the ECB to take more drastic stimulus measures – and there is no uniformity of agreement that such measures would be able to deliver the remedies necessary to maintain harmony in the Eurozone.

Drama in Three Acts, or Five?

We have shared our general concerns about Europe for quite some time on these pages, and this week’s drama in Greece reinforces those concerns. We do not believe that the integrity of the single currency zone is as threatened as it was in late 2011, or that peripheral spreads are on the verge of soaring upwards. The ECB’s Draghi remains committed to the Eurozone and he still has dry powder to deploy if need be. But the structural case for Europe remains weak. Until we see more fundamental signs of life – in areas like employment and consumer prices – we remain underweight in our exposure to the Continent’s asset markets. Meanwhile, we will be paying close attention to the outcome of next week’s snap election and its potential consequences.