The job numbers released by the Bureau of Labor Statistics this morning were broadly upbeat for the American labor force. Even wage growth and labor force participation, which have been the “yes, but” metrics in recent months, showed movement in the right direction. There is an important caveat to the good news, of course. If we really are at the juncture where jobs growth puts upward pressure on wages, we are probably closer to that day when the Fed begins raising rates. The question is whether higher growth will trump rising rates as a market driver. The answer to this question will likely give us near-term directional clues to both stocks and bonds.

Year of the Century

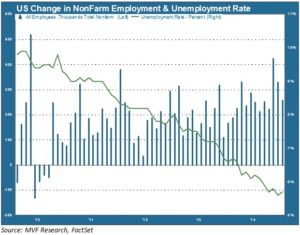

2014 turned out to be the best year for jobs growth in the U.S. since 1999 – better than any year during the 2003-07 recovery and capping a steady recovery since unemployment peaked at 9.9% in late 2009. The chart below shows the five year trend in the headline unemployment rate and payroll growth.

Wage growth, as we have noted in recent commentaries, has been patchy for much of this time. But average hourly wages for January grew by 12 cents, bringing year-on-year wage growth to 2.2%. That is not particularly impressive by historical standards, but it does mean that wages are managing to stay ever so slightly ahead of inflation. Add to that a bit of relief at the gas pump, and the case for a pickup in household spending comes into focus. Of course, one month of improved wages does not a trend make. And labor force participation, though up slightly from last month, is still close to multi-decade lows, meaning that there is still plenty of spare capacity. But the overall picture is one where the U.S. shows little sign of getting dragged into a global deflation pandemic.

Your Move, Chairwoman Yellen

Are the January jobs numbers enough to put a rate hike by mid-year back on the table? The yield on the 10-year Treasury is heading back towards 2% after spending most of the year to date well below that threshold. The 2-year note yield, which as a short-term rate will be more closely influenced by Fed policy, is less than 10 basis points away from its 52 week high. The bond market may be reassessing its no-growth-anywhere outlook and coming to terms with a higher likelihood for rate policy action in 2015. It’s too early to write it in the books, though. The Fed meets next in March, and there are plenty of macro data points on tap between now and then (including, yes, another jobs number). Inflation remains below 2%. But unless the growth numbers are all completely illusory, prices will at some point trend upwards, and probably sooner rather than later.

Low Rates Good, Strong Growth Better

While there is no telling how stock markets will react in the day-to-day environment approaching any rate hike, we believe there is a better case to make that growth will, indeed, trump rates as the key market driver. Much of the higher volatility we have seen in the year to date has had to do with uncertainty about growth and the specter of global deflation. That specter will most likely not disappear completely as long as other economies and the U.S. remain on divergent paths. But home-grown organic growth should provide a tailwind in navigating the course through rising rates.

That being said, though, there are upside risks as well. The strong dollar is having a pronounced effect on U.S. corporate earnings. “FX headwinds” is perhaps the most overused phrase on quarterly earnings calls in recent memory. An environment of growth and higher rates could drive the greenback higher still against the euro, yen and other key currencies. That could have a disproportionate effect on large multinational stocks and work in the favor of those enterprises with a smaller global footprint. So while the overall market trend may continue up, this could be a year when judicious stock selection matters more than it has recently.

Wage growth, as we have noted in recent commentaries, has been patchy for much of this time. But average hourly wages for January grew by 12 cents, bringing year-on-year wage growth to 2.2%. That is not particularly impressive by historical standards, but it does mean that wages are managing to stay ever so slightly ahead of inflation. Add to that a bit of relief at the gas pump, and the case for a pickup in household spending comes into focus. Of course, one month of improved wages does not a trend make. And labor force participation, though up slightly from last month, is still close to multi-decade lows, meaning that there is still plenty of spare capacity. But the overall picture is one where the U.S. shows little sign of getting dragged into a global deflation pandemic.

Your Move, Chairwoman Yellen

Are the January jobs numbers enough to put a rate hike by mid-year back on the table? The yield on the 10-year Treasury is heading back towards 2% after spending most of the year to date well below that threshold. The 2-year note yield, which as a short-term rate will be more closely influenced by Fed policy, is less than 10 basis points away from its 52 week high. The bond market may be reassessing its no-growth-anywhere outlook and coming to terms with a higher likelihood for rate policy action in 2015. It’s too early to write it in the books, though. The Fed meets next in March, and there are plenty of macro data points on tap between now and then (including, yes, another jobs number). Inflation remains below 2%. But unless the growth numbers are all completely illusory, prices will at some point trend upwards, and probably sooner rather than later.

Low Rates Good, Strong Growth Better

While there is no telling how stock markets will react in the day-to-day environment approaching any rate hike, we believe there is a better case to make that growth will, indeed, trump rates as the key market driver. Much of the higher volatility we have seen in the year to date has had to do with uncertainty about growth and the specter of global deflation. That specter will most likely not disappear completely as long as other economies and the U.S. remain on divergent paths. But home-grown organic growth should provide a tailwind in navigating the course through rising rates.

That being said, though, there are upside risks as well. The strong dollar is having a pronounced effect on U.S. corporate earnings. “FX headwinds” is perhaps the most overused phrase on quarterly earnings calls in recent memory. An environment of growth and higher rates could drive the greenback higher still against the euro, yen and other key currencies. That could have a disproportionate effect on large multinational stocks and work in the favor of those enterprises with a smaller global footprint. So while the overall market trend may continue up, this could be a year when judicious stock selection matters more than it has recently.