It turns out, apparently, that Netflix was the canary in the coal mine. Recall that a few weeks ago the streaming giant stumbled after an earnings call revealed a decline in new subscribers for the first time in a decade. Netflix stock, one of the highest-flying names of the last decade, plummeted by almost 70 percent in a matter of hours. The concern was that as inflation picks up, consumers might finally be starting to make decisions that result in dropping some items from their monthly budgets, and streaming services might just be one such thing.

Not So Defensive

Fast forward to this week and the fate of some of the most redoubtable companies in the consumer goods space. Walmart and Target are nobody’s idea of a sexy high-octane growth engine; they are the venues that draw in the dead-center middle of Middle America every week for groceries, basic household goods and occasional splurges. These types of consumer goods companies have long been seen as defensive plays in times of trouble; bad economy or not, people still need to buy toothpaste and shower curtains and clothes for the kids.

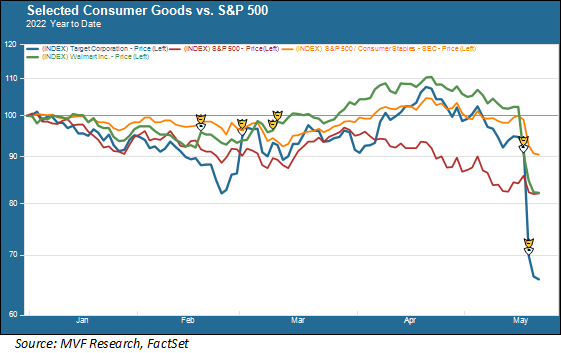

Until this week, that maxim seemed to be working in the current market as well, with both Target and Walmart as well as basic consumer goods companies in general holding their values better than the broader market indexes. But then came the earnings reports, and this happened.

To be sure, the news was not all bad. Sales for both Walmart and Target grew slightly faster than expected, in low-mid single digits broadly reflective of US consumer spending overall (recall that the consumer spending component of Q1 GDP grew 2.7 percent). So far, anyway, sales are doing okay. The problem is with earnings and profit margins – both companies experienced an “earnings miss” where earnings per share came in below the consensus expectations of the securities analysts who cover them. Margins – profits expressed as a percentage of sales – are down due to the persistence of higher costs for key inputs (including labor and raw materials) and logistics (e.g. freight and other transportation costs). If companies are not able to raise prices by enough to compensate for the higher cost structure, then margins come down. Observers fear that this could be the beginning of a more sustained trend of margin erosion that will eventually show up in reduced consumer spending – conceivably enough so to push the economy into negative growth.

Confident, Or Not?

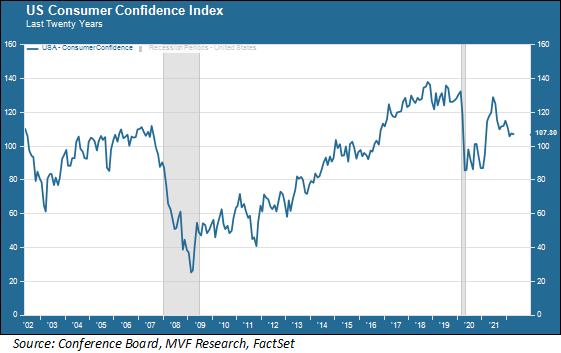

To repeat, the evidence of reduced consumer spending is not there yet, as reflected in the better-than-expected revenue growth numbers for Walmart and Target (among others). The old saying goes that economists and markets are famous for having predicted seven of the past three recessions, and there is plenty of prediction talk out there today without – yet – the evidence to back it up. In two weeks we will get another chance to assess the state of the consumer’s mind when the Conference Board’s consumer confidence numbers come out on the Tuesday after Memorial Day. As the chart below shows, the confidence number has held up pretty well recently, currently right around levels that suggest the middle of an economic growth cycle.

A poor reading for consumer confidence would not be a great way to end the already troubled month of May, while investors could take heart if the number doesn’t drop too much from the April reading. The mood of the market is clearly fragile as an “everything is bad” sentiment sets in for volatile intraday trading cycles. It will take a few more clear data points in favor of continued growth to get Mr. Market to back away from talking himself into the next recession.