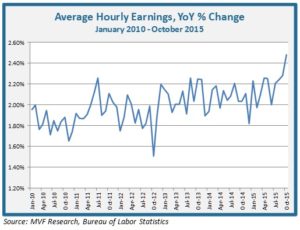

Stocks threw a mini-tantrum earlier in the week after Fed Chairwoman Janet Yellen made it pretty clear that she really, really wants to get that first rate hike on the board in December. Today’s jobs release from the Bureau of Labor Statistics goes a very long way to help make the Chairwoman’s wish come true. While the headline number of 271,000 new jobs is impressive enough, given expectations for just 180,000, it is the wage number that should really move the dial very close to rate hike certainty. As the chart below illustrates, year on year wage growth is stronger than it has been since the beginning of 2010, and the first real upside breakout over this time period.

Wage-Price Tango

To be clear, this is just one month’s worth of data. But the 2.5 percent year-on-year growth in wages finally seems to square with much of the anecdotal evidence dribbling in from corporate earnings calls this quarter, from the likes of Wal-Mart among others. Wages do seem to be gaining traction. The unemployment rate, at 5.0 percent, is half its level at the height of the jobless trend and just ten basis points above the 4.9 percent level often cited as the full employment threshold. This recovery has been decidedly low-wage up to now, and even at 2.5 percent it remains below pre-recession norms. But some degree of normal cause-and-effect still prevails in this economy. With higher wages should come higher prices, sooner or later. In her recent comments Yellen has conveyed a line of sight to that elusive 2 percent inflation target. That target is finally starting to come into our sight range as well.

December Divergence

So the stars seem to be aligned. Yes, a truly miserable November jobs report – and we would imagine the misery threshold to be somewhere around 50,000 or fewer payroll gains – could put plans back on ice. Another stock market meltdown could do the same. But with the default scenario now fully pricing in a rate hike, our attention floats across the pond to Europe. ECB Chairman Draghi appears ready to expand the current quantitative easing program if need be, probably by extending the planned September 2016 end date. Heading further east, the Bank of Japan passed on further easing in its deliberations last week. But the consensus opinion among observers is that, barring some unexpected stimulatory impact from one of Abenomics’ fiscal arrows, monetary action will once again need to ride to the rescue there. All this would appear to point to the very real possibility of policy divergence among the world’s principal developed regions. That has never happened, so we will be headed into uncharted waters as we transition into 2016.

Growth Trumps Rates

Yes, we have used the “Growth Trumps Rates” headline in previous commentaries, but it is a useful reminder for us that we would rather live in a world of rising interest rates and economic growth than zero-bound rates and stagnation. We do not think growth here at home should necessarily be stymied by monetary policy divergence, should that come to pass. The Eurozone economy has managed to slightly outperform what were admittedly fairly low expectations at the beginning of the year. If Chairman Draghi believes an extra shot of QE will move it further back from the deflation cliff, then so be it. A continued headwind for US exports, to be sure, but we would expect the impact on GDP to be largely offset by brisker consumer spending at home, helped along by improving wages.

This scenario in turn feeds into the “quality rally” thesis we have set out in recent weekly commentaries. This thesis sees companies able to demonstrate competitive advantage – evidenced for example by double-digit top line growth despite FX headwinds, emerging markets softness and other challenges – as likely to outperform their peers. To some extent this trend is already underway. A December rate hike should provide confirmation for this new phase of the bull market. The training wheels are coming off, and future price gains should be more about the good old metrics of free cash flow generation and strategic execution than about QE and zero percent rates.