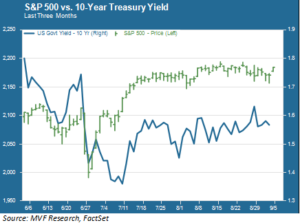

For anyone who likes to keep a record of these things, the S&P 500 broke out of its last corridor fever back on July 8, when it finally topped the previous record close set on May 21, 2015. The large cap benchmark index went on to set five more consecutive records and, for good measure, added three more before July drew to a close. In August the pace slackened, with three fairly unconvincing new record highs languidly popping up amidst yet another overall sideways drift. Bonds likewise showed little inclination to exert any directional effort, as the yield on the 10-year Treasury note meandered between 1.5 and 1.6 percent for most of the month. The lazy, hazy days of both assets are shown in the chart below.

August has now ceded the calendar to September, that notoriously tricky and sometimes perilous month. It’s time to once again take stock of what may be at play as the baton passes from the third to the fourth quarter.

A Policy-Less Equinox

The autumn equinox will approximately coincide with the Fed’s next policy meeting, and there will be more action in the celestial realm than the terrestrial. Yes, we have been saying for many weeks now that we expect no rate action in September on account of X, Y and Z reasons, but today’s jobs release should be the final word on this matter. It’s not that the jobs report was bad – the payroll number was below expectations as was the average wage growth figure, but the quality of job gains has improved over an intermediate-term basis. It’s simply that there is no reason of any urgency for the Fed to move on rates while nothing – not jobs, not inflation, not GDP, certainly not productivity – suggests even a hint of dangerous economic overheating. Short of an unimaginable surprise coming out of the next CPI release on September 16, that calculus won’t change. So go out and enjoy the official transition from summer to fall without worrying about anything that’s going on in Washington DC’s Eccles Building.

Earnings and Valuations: Will They Matter?

With nothing much in the way of policy events, then, attention should reasonably turn back to earnings and the fact that stock prices remain very expensive by the usual valuation metrics. Consensus earnings for 3Q 2016 have slipped again, with the FactSet analyst consensus outlook once again calling for a decline in average S&P 500 earnings per share by more than two percent. If realized, that would put calendar year 2016 under the water and notch six straight quarters of earnings declines. Headwinds including the strong dollar and weak foreign demand have not gone away. The next twelve months P/E ratio, meanwhile, remains near a 12 year high.

Those are the facts and they are hard to dispute; the question is whether they will matter much or whether benign sentiment will prevail for what may be perhaps a last giddy rally before investors come around to contemplating a 2017 landscape filled with potential landmines. We’ll have more to say about next year as we get closer to our annual outlook in January; at least from our vantage point today, that may be shaping up to be a sobering conversation.

Surprise, No Surprise

A giddy late-2016 rally would in our opinion be a more likely outcome if we do indeed get through that twisty period from about mid-September through early October. That, in turn, depends largely on the absence of any out-of-the-blue surprises that force a radical revaluation of asset price models. The good news, perhaps, is how immune markets seem to be to surprises these days. Brexit is the poster-child for this sanguinity in the face of surprise; the outcome was unexpected, the potential real-life consequences far-reaching, and yet the market response was crammed into just two days of negative reaction followed by a relentlessly upbeat relief rally.

Think ahead to the weeks leading up to the US presidential election. Is there any possible outcome that could exert a real shock effect on the market – meaning one which lasts more than a week and which pulls risk asset prices into sustained double-digit declines? If there is, we don’t see it. The market already assumes that the US political system is broken, that November’s outcome will not fix the dysfunction regardless of who moves into the White House and occupies a majority on Capitol Hill, and that the Fed will retain its independent role as the sole architect of actual economic policy. If nothing changes that equation, we believe, nothing will truly surprise the stock market.

So here we go. We imagine the fall will contain more rollicking times than did summer, but we don’t see the case for too many far-reaching tactical moves. 2017, though, may be another story entirely.