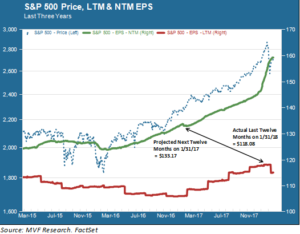

Every fiscal quarter, publicly traded companies and the securities analysts who cover them engage in a series of time-honored rituals. The rituals follow the elaborate pantomimes of a Japanese Kabuki drama, and the underlying message is almost always the same: Hope Springs Eternal. Consider the chart below, which shows quarterly earnings per share trends for the S&P 500.

How to Speak Kabuki

Here’s how to interpret this chart. The green line represents projected earnings per share for the next twelve months. Basically, analysts project what they think will happen to the companies they analyze in the year ahead, based on the economic context and all the usual industry- and company-specific competitive variables, and those assumptions boil down to the one NTM (next twelve months) EPS figure. This chart shows the composite NTM EPS for all the companies in the S&P 500. For example, on January 31, 2017, the composite estimate for what S&P 500 shares would be worth a year hence (i.e. at the end of January 2018) was $133.17 per share.

The red line illustrates the actual earnings per share for the twelve trailing months, known in finance-speak as LTM (last twelve months). So if the green line represents the hope, then the red line shows the reality, or what actually happened. As you can see, the actual LTM earnings per share for the S&P 500 on January 31, 2018 was $118.08. It wasn’t $133, as the analysts had forecast a year earlier.

Moreover, the chart shows that this “reality gap” plays out in virtually every quarter, year after year. What often happens as earnings season approaches is that analysts start to dial back their earlier predictions to bring them closer to reality. In so doing, they are playing another important role in the Kabuki drama: managing expectations. Earnings season is only partly about the actual growth number; it is also about whether this number is better than, or worse than, what was expected. The downward revision that customarily takes place in the weeks before a company reports has the effect of lowering the bar, so that whatever number the management team actually reports has a better chance of beating expectations.

This Time Is (Sort of) Different

Clear as a bell, right? In summation: expected earnings are usually rosier than the actual figures that come out later, and the elaborate play-acting between management teams (forward guidance) and securities analysts (downward revisions to expectations) contrives to deliver happy surprises to the market.

Except that the script is a bit different this year. Analysts are actually raising – not lowering – their expectations for 2018 earnings performance. Let’s consider the case for Q1 2018. This is the quarter we are currently in, so we don’t know how the companies are actually going to perform. What we do know is that the analysts’ consensus estimate for Q1 S&P 500 earnings as of today is 17.1 percent growth. When the same analysts made their Q1 forecasts at the end of last year, the estimate was 10.9 percent. That’s a big difference! And not just for Q1. The analysts’ Q2 estimate is also significantly higher today than it was seven weeks ago. In fact, the consensus estimate for full year 2018 earnings growth is 18.2 percent, which is 8 percent higher than on December 31, when analysts predicted growth of just 10.3 percent.

That difference – the difference between 18 percent and 10 percent – matters a lot for equity valuation. If companies in the S&P 500 grow their earnings by 18 percent this year, then a similar rise in share prices will not make stocks any more expensive, when measured by the price-earnings multiple variable. That would ease investors’ worries about a potential share price bubble. Double digit price growth matched by double digit earnings growth is arguably the best of all possible worlds for long equity investors.

Here is the one caveat. Much of the apparent optimism in the current earnings projections comes from one single fact – the tax cuts enacted in December that were disproportionately skewed towards corporate tax relief. You can see from the green line in the above chart just how dramatically expectations accelerated right around the time the relief package took shape. More than any other factor, the tax cuts help explain why, contrary to the usual practice, earnings estimates have been raised rather than lowered as reporting dates come closer (though we should also note that a weaker US dollar, should it persist, could also be an earning tailwind for companies with significant overseas activities).

More to Life than Taxes

Investors should take in this seemingly good news with a measure of caution. First, to the extent that the tax relief does make a strong impact on the bottom line (which would be the case for companies that actually pay something close to the previous statutory tax rate, by no means a majority of S&P 500 companies) it will be a one-and-done kind of deal. The growth rate will kick up for one fiscal year cycle of “comps” – comparisons to the previous year – and then stabilize at the new level.

Second, there are other variables in flux that could at least partially offset the tax advantages. Corporate borrowing will be more expensive if (a) interest rates generally continue to rise and (b) credit spreads widen in response to higher market volatility. Companies in more price sensitive industry sectors may have to address issues of how much new inflation they can pass on to their customers. And, of course, corporate top lines (sales) will be dependent on the continuation of global economic growth leading to increased organic demand for their products and services.

Finally, the only way that companies can consistently grow their earnings above the overall rate of GDP growth is through productivity-enhancing innovations to their value chains. There may be a new wave of such innovations just around the corner – or there may not be. How these developments play out over the coming months will determine whether the current rosy predictions of the analyst community play out – or whether they quickly go back to that familiar old Kabuki script of hope and reality.