There’s a lot of chatter out there about how the summer of 2021 is shaping up in equity markets. The bumpy-ride faction has enjoyed some validation recently, with volatility perking up after seeming to settle down at sub-20 levels on the VIX (kudos to whoever made that $40 million option bet a few weeks ago with a VIX-25 trigger). The sentiment that “volatility is back, baby” got some help from the plight of cryptocurrencies this week – yet another attestation, it would seem, to the rapid unwinding of those latterly high-flying speculative corners of the market.

Value Hits Pause, Again

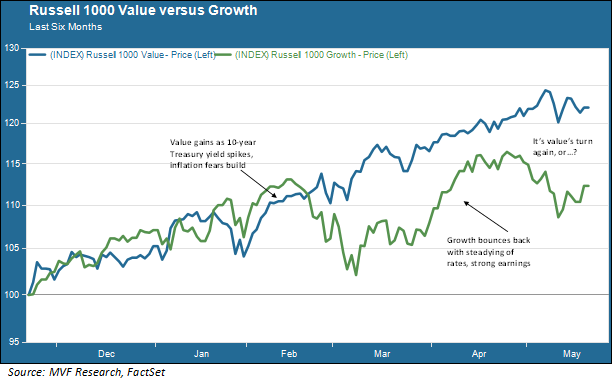

What didn’t happen this week, though, while bitcoin and its ilk were flapping all over the place like injured cicadas falling off their trees, was another leg up for value stocks in their storied comeback against growth. The value rotation, of course, has been one of the big themes of 2021 thus far. As the chart below shows, though, it has not exactly been a seamless progression.

The big tailwind for value in the year so far was the sudden spike in interest rates back in late January, and the attendant rise in inflationary expectations. The sentiment benefitted key value sectors like financial institutions (higher rates = better net interest margins) and energy (real assets like commodities do well in inflationary environments). But that narrative sort of petered out in early April as rates started to stabilize and early signals pointed to a blowout earnings season (which signals have since been resoundingly confirmed). As the chart shows, growth’s gains narrowed the value rotation gap significantly. Who cares about those pesky valuations when earnings are set to top 30, maybe even 40 percent this year? Party on, Wayne!

Anything Goes

The gap widened again, though, as volatility retuned and actual inflation numbers started to come in. To be clear the Personal Consumption Expenditure (PCE) index (less food and energy), the Fed’s go-to inflation metric, is still below the central bank’s two percent target. But the Consumer Price Index, the inflation measure more familiar to Americans who don’t work at the Fed, jumped up to three percent (again, the core number that excludes food and energy) while producer prices, reflecting higher input costs for raw materials and transportation, notched a four percent increase.

Yet the trend seems to have stabilized once again. The really frothy end of the growth stock universe, where names like Tesla frolic and play, seems to have calmed down while the megacap leaders like Microsoft and Apple have come off their recent lows. On any given day, it seems, one thing may be up and the other down (yesterday it was growth, today value). Perhaps unsurprisingly, that dynamic adds up to a meandering market overall, rather than a discernable directional vector up or down. We’ve seen this dynamic before – meandering could foretell a relatively quiet summer where the market doesn’t do too much and the competing narratives moving value and growth more or less cancel each other out over time. But even a quiet spell can encounter those periodic pockets of turbulence, and we will not be surprised to see a few more of those along the way.