Just a couple years ago, the notion of “secular stagnation” was a favorite topic of conversation in the tea salons of the chattering classes. Secular stagnation is the idea that structural forces are at play pushing the growth rate of the global economy ever farther away from what we call “historical norms” (which really means “average rates of growth since the end of the Second World War”). Former Treasury Secretary Lawrence Summers was a leading proponent of the secular stagnation theory, pointing to widespread evidence of reduced levels of business investment and subdued consumer demand. Secular stagnation offers a different explanation of economic performance than the usual ups and downs of the business cycle. It suggests that the very idea of “historical norms” is meaningless: the world, and the world’s economy, has changed in profound ways since the 1950s and the 1960s, and there is no point in benchmarking current trends off those prevailing sixty and seventy years ago.

Hit the Mute Button

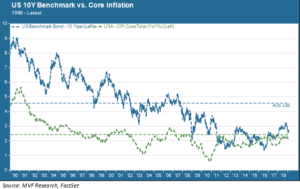

Secular stagnation lost quite a bit of mojo in the immediate aftermath of the 2016 election and the brief infatuation with the “reflation-infrastructure” phenomenon that was supposed to happen when the incoming administration turned on the full force of corporate tax cuts and deregulation. Although the tax windfall did arguably give a momentary sugar high to GDP growth rates, it didn’t have much of a sustained effect on business spending levels. And it had absolutely no effect on inflation. The chart below shows the long term inflation trend (core inflation, excluding food and energy) along with the corresponding ten year Treasury yield. The data go back to 1990.

There are a couple noteworthy things about this chart. The first is that inflation really has been a non-factor in the US economy since the mid-1990s. Core inflation has not risen above three percent since 1996. Through up cycles and down cycles, inflation has been – to use the word that is now embedding itself into the working vocabulary of the Federal Reserve – muted. And of course, in the recovery that began in 2009 core inflation has never even come close to the three percent level it last flirted with at the height of the manic real estate boom of 2006.

The second thing to observe in the above chart is the subduing of long term interest rates. We have talked about this in recent weeks, but here we focus on the 10-year yield as a barometer of inflationary expectations. One plausible reason for the persistence of the low benchmark yield – even after the Fed stopped buying intermediate term bonds as part of its QE programs – is that bond markets bought into the structural nature of muted inflation long before the Fed did. When the FOMC’s January 30 communiqué seemed to make official the Fed’s view of lower-for-longer inflation, one can picture the bond market replying thus: Thanks for telling me what I already know.

Alvin Hansen Gets His Day

And with that, a long-dead economist may finally have his life’s work recognized in formal monetary policy. Alvin Hansen was the originator of the term “secular stagnation,” way back in 1938. That was a grim year. Six years after the peak of the Great Depression, monetary authorities gingerly attempted to tighten policy and prevent the recovering economy from overheating. Things went south quickly, and policymakers realized that the economy was still too fragile to withstand traditional medicine.

Hansen’s secular stagnation theory seemed on the money at the time. Fortunately for the country, if not for Hansen’s own posterity, the theory quickly went out the window when the economy reflated onto a war footing as the Second World War broke out. Now that’s an infrastructure-reflation event! And dormant the theory lay until resurrected by Dr. Summers et al in the mid-2010s. We may still be one or two FOMC meetings away from calling it the dominant interpretation of today’s economy. But barring some genuinely massive exogenous shock to reflate the economy, the pattern of core inflation suggests that “lower for longer” is indeed what the world is going to have to get used to.