A deadly terrorist attack in Nice last Thursday was followed by a failed coup over the weekend in Turkey. China’s contentious “Nine-Dash Line” in the South China Sea is on a potential collision course with the U.S. military. A dismal post-Brexit PMI reading in Britain offers the first piece of data suggesting a possible autumn recession. Establishment institutions around the world reel from public distrust, and in politics it seems conventional rules no longer apply.

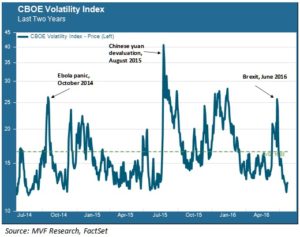

Yet stock markets appear blissfully dismissive of the planet’s woes. The S&P 500 has resumed its record-setting ways after a hiatus of more than one year. Meanwhile the CBOE VIX, the so-called “fear gauge” of market sentiment, fell to a two year low earlier this week, a stunning 54 percent plunge from the June 24 high in the immediate aftermath of Brexit. Do these signals – a placid VIX and a stock market upside breakout – signal the beginning of another extended run for the seven year old bull? Or are we in a brief calm before the next storm?

Mood Swings

The VIX is subject to abrupt and dramatic mood shifts, as the above chart clearly shows. Those Alpine spikes tend to occur when something unexpected shocks investors out of complacency. Three notable examples in this chart, which goes back two years, were the Ebola freak-out in October 2014, the Chinese yuan devaluation in August 2015 and of course the Brexit shock last month. The Ebola and Brexit events appear similar in their brevity – less than a week of fear – and in the fact that in both cases stocks went right back to setting record highs. In both cases the market’s snap judgment appeared to be “nothing here, carry on”.

By contrast, risk and uncertainty lingered longer after the yuan devaluation last August, with the VIX staying at an elevated level for about five months until peaking again this past February. This is perhaps not surprising. The importance of China to the world economy makes it harder for investors to simply shrug off a negative surprise like the devaluation. Questions about China’s growth sustainability, debt overhang and impact on world commodity markets remain, even if they have mostly been out of the headlines of late.

A Tale of Two PMIs

Is Brexit really just an Ebola-like flash in the pan, an event unlikely to have much impact outside Great Britain’s borders? Since the vote one month ago (a month already, really?) there has been plenty of opinionating about what it all means, but not much in the way of data. Today we finally got a little quantitative morsel on which to chew. The July monthly purchasing managers surveys (PMI) came out for both Britain and the Eurozone, and they painted a distinctly diverging picture. In the Eurozone, both the manufacturing and the services PMI came in right about where they were a month ago, at 51.9 and 52.7 respectively. A PMI greater than 50 signifies an expansion while a number below 50 indicates a contraction.

In the UK, by contrast, the manufacturing PMI fell from 52.1 last month to 49.1 in July, while the services PMI fell from 52.3 to 47.4. Analysts have been quick to point out that the data are consistent with a scenario for a UK recession as early as this fall. We should note that PMI is only one measure of economic activity, so due caution is advisable before rushing to judgment. In our opinion, though, if there is anything substantive to take away from today’s PMI it is the Eurozone number. A British recession spilling over into a Eurozone recession would be cause for concern, but evidence in support of that scenario has not shown up yet. Indeed, while leaving Eurozone interest rates untouched this week, ECB Chair Mario Draghi expressed confidence in the current economic state of the union.

Not Worried, or Not Present?

Perhaps the market is right that, even with all the mayhem going on in the world, there is no compelling case to make for the bull to change course and reverse. It’s also possible that the lack of worry indicates that nobody is paying much attention. As we noted in our piece last week, we are in that time of the year when trading volume subsides and gives way to beach reads. Volume on the New York Stock Exchange has been well below average during the recent post-Brexit rally. Maybe investors are more concerned about leveling up in Pokémon than they are about world events. For now, in any event, this quiet spell appears fairly impervious to disruption.