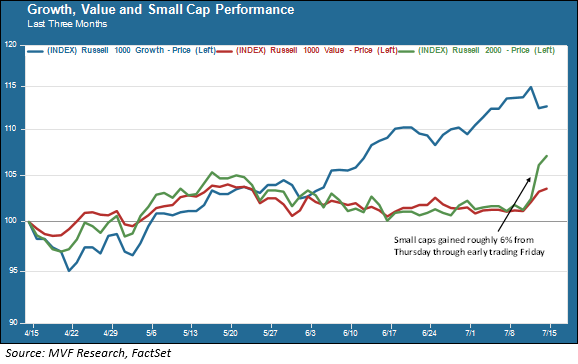

One day does not a trend make. But yesterday was a doozy of a reversal in the fortunes of large cap growth stocks and their long-suffering compatriots in large value and small caps. That, necessarily, begat a flood of chatter about one of the most beloved themes among financial talking heads – The Rotation. We have seen this movie before, and more often than not it proves to be a head fake rather than a sustained development. But given how long growth’s outperformance has been going on, and how expensive many of these stocks have become, it’s worth at least delving into the whys and the wherefores. As the chart below shows, the small cap frenzy in particular is continuing unabated in the early hours of trading this morning.

CPI Tailwind

Yesterday’s big move was not without a catalyst. The June Consumer Price Index (CPI) report came out an hour before trading commenced and delivered the pleasant surprise of lower than expected price gains for the month of June. The all-items headline number actually fell by -0.1 percent, thanks largely to a decline in gasoline prices. The more Fed-relevant core CPI gained 0.1 percent, lower than the 0.2 percent predicted by economists, bringing year-on-year core CPI down to 3.3 percent. This marks the third month in a row for a reasonably benign CPI, after the unexpectedly high readings earlier in the year.

All well and good, but why should lower inflation have an outsize impact on small cap stocks? The easiest and probably most relevant answer to that question is that lower inflation increases the likelihood that the Fed will start cutting interest rates in September. The market promptly priced in a 95 percent probability of that following release of the CPI report. Lower interest rates can be particularly beneficial for smaller companies which are more sensitive to changes in operating leverage – interest is a fixed expense you have to pay regardless of whether your revenue is going up or down, so it can eat into profit margins, which is especially important when economic conditions are slowing, as they have been recently. As long as the slowdown stays within the parameters of “soft landing” and doesn’t turn into something worse, lower interest rates will help smaller companies keep their profit margins from turning dramatically lower.

What About the Other Side?

Of course, 3.3 percent core inflation is still not 2.0 percent core inflation, and all it would take would be another sticky CPI report showing monthly gains of 0.4 percent, like the January and February readings, to throw a wet blanket over yesterday’s good cheer. So we will watch and wait before forming any deep convictions about the durability of this rotation. But there is another question as well, and that pertains to the large cap growth stocks that got dumped yesterday. Was it just some reflexive tactical reallocating of portfolio weights, or are there reasons to be more skeptical of this asset class’s recent run of good times?

We will have a more in-depth look at this question next week, when we revisit a theme we brought up several weeks ago about the business case for generative artificial intelligence. In the storied annals of stock market history there are a handful of variations around the theme of “X looked great, until it didn’t” where “X” at different times has been railroads, industrial chemicals, automobiles, oil production, e-commerce…you get the picture. At some point, many of today’s darlings are likely to become part of this colorful history. But (to give a little preview of next week’s topic) that day of reckoning may still be some ways away. See you next Friday!