Just when you thought it was safe to go back into the water…

One of the overriding narratives of the past several months has been a building case for stronger than expected economic growth. The headline numbers – GDP, employment trends, housing and consumer confidence to name a few – were pointing in the right direction. This morning, that narrative took a body blow with the release of the December employment report. It remains to be seen whether this is an outlier, a case of bad data that missed heightened seasonal variables, or a sign that those green shoots are not putting down roots as strong as we thought. In the meantime, we may be seeing lots of confusion in the markets and lots of false signals about directional trends as investors try to make sense of what this means for the economy, for the Fed, and for different asset classes.

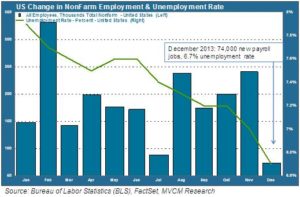

Here are the key data points from today’s report in chart form.

Some Very Opaque Tea Leaves

The Wall Street Journal’s monthly jobs report liveblog captured the Zeitgeist perfectly. In the minutes before 8:30 a.m., the numbers being tossed around ranged from 200,000 to 300,000 for the payrolls, with a general consensus for the headline rate staying around 7%. As the bell tolled on the half hour, there was a microsecond of stunned silence, and then a chorus of “huh?” and “what the…?” filled the ether. Why did only 74,000 payroll jobs get created in what is normally a busy hiring month? And how did such a weak reading actually bring down the unemployment rate?

Opt-Out Nation

That second question is the easier one to answer. The rate came down because fewer people are actively looking for jobs. The labor participation rate is 62%, slightly down from where it was a year ago. That means that very few people are coming off the sidelines and back into the labor force. Unless there is some unexplained cultural phenomenon to account for that, it means that job creation levels are not yet strong enough to be putting a larger percentage of the population back to work.

Anomaly or Bad Data?

There is a sizable contingent of opinionators questioning whether the BLS data are believable, given how far from the consensus they turned out to be. Of course, dismissing the validity of a data point is a tried and true Wall Street dodge for predictions gone egregiously wrong. Still, there is a distinct possibility that the December numbers will be substantially revised when the next reading comes out in early February. Last fall’s government shutdown threw a wrench into the monthly reporting rituals, and while that should not still be causing problems, there may be something to the idea that the data are not all that robust.

One thing the BLS did note in its report is that 279,000 people did not work in December on account of the weather (it was unseasonably cold in much of the country during the month). That would partially explain some of the lower-level findings, like the 16,000 jobs lost in construction. But it doesn’t shed much light on why, for example, the healthcare sector lost 7,000 jobs against an average monthly increase of 13,000 for 2013 overall.

Over to You, Chairwoman Yellen

How markets react to this news in large part depends on what consensus emerges about the Fed’s likely moves when it meets later this month. Bear in mind that this is the maiden Board of Governors meeting for incoming Fed Chairwoman Janet Yellen. Last month the Fed decided to begin rolling back its $85 billion monthly bond buying program known as quantitative easing. With QE tapering off, the policy tool du jour is forward guidance on interest rate policy. The Fed extended its forward guidance, saying that it would keep rates at zero percent until “well past” the time when unemployment reaches 6.5%.

Immediately after that announcement, short term interest rates shot up. That seemed to indicate doubt among investors as to whether extending the historically low Fed funds rate that far ahead, possibly into 2016, would be possible if the economy really were catching fire more quickly than expected. Part of that doubt concerned exactly the issue that is front and center today: the labor participation rate. If unemployment reaches 6.5% mostly because people are still dropping out of the labor force, then the Fed has more leeway to keep rates down. If the rate comes down for the “right reasons” – i.e. more actual job creation – that could create upward pressure on prices and force the Fed to act sooner.

So if the December reading is in fact not an anomaly, but a sign that things aren’t as rosy as they have been looking recently, then look for more dovish overtures from the Yellen Fed, and maybe even a pause in the QE taper. If this is a one-off, or bad BLS data that gets revised upward next month, perhaps the old narrative continues. At this point we don’t know, but we do expect the fog of uncertainty may complicate the market’s direction over the coming weeks.