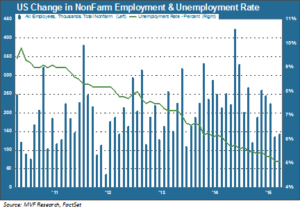

A cold, wet rain has been falling along the Eastern Seaboard for the past couple days, and that proved to be an appropriate climate for this morning’s September jobs release. If there was any good news to be found in the report it was not apparent in the headline numbers. The 142,000 payroll gains for September, along with surprising downward revisions for August and July, pulled the average monthly job growth figure for the year to date down to just below 200,000, seen by many as a critical threshold for the overall economic growth equation. As the chart below shows, the job creation cadence is at its lowest level since the first half of 2012.

Meanwhile, average hours worked per week fell slightly, as did hourly wages. And once again the unemployment rate held steady partly due to another decrease in the labor participation rate, which remains firmly mired at levels last seen in the 1970s. Now, we are always ones to caution against reading too much into one data release, or even a couple successive data releases. Statistical margin of error and all that – you’ve heard it from us a hundred times. But at some point it becomes reasonable to ask a very simple question. Seven years after the Fed opened its monetary floodgates to try and return the economy to normal, is this as good as it gets?

Money, Myths and the Real Economy

To deal with that question we need to start with a closer look at what the Fed actually did, as opposed to what lots of people think it did. The popular view is that, after realizing that taking short term interest rates down to their zero lower bound was insufficient to the task at hand, the Fed flooded the economy with money via the three successive quantitative easing programs carried out from 2009 to 2014. That, in fact, is not what happened. The misunderstanding comes from how money is defined in its popular usage versus the much more complex terminology at play in the world of Fed monetary policy mechanisms.

When the Fed purchased government and mortgage backed bonds through the QE programs it did not “print money” as the popular myth goes. It bought the securities from banks, and paid for those securities by crediting the reserve accounts these banks held on deposit at the Fed. Bear in mind that banks are required by law to maintain a certain percentage of their outstanding deposits in the form of these Fed reserves. By increasing the banks’ reserves, the Fed was effectively giving the banks the means to go out and make more loans, thus stimulating economic activity. That was the point of QE.

Monetary Speedbumps

Except that it didn’t happen. What happened instead is that the overwhelming majority of those newly created reserves never went anywhere. They stayed in the banks’ Fed accounts and added not a single cent’s worth of stimulus to the real economy. To illustrate this, consider the following. The US monetary base – which consists of currency in circulation plus bank reserves held at the Fed – was about $875 billion in August 2008. In August 2014 the monetary base surpassed $4 trillion and it has mostly remained above $4 trillion since then, even after QE3 wound down. The monetary base, in other words, is more than 4.5 times greater in 2015 than it was in 2008. Almost all the growth came from the reserve account increases proceeding from QE.

Now consider that M2 – a broad measure of money in the economy that includes currency, checking and deposit accounts and money market funds – grew from about $7.7 trillion in August 2008 to $12.1 in August 2015. This means that M2 is less than twice as big today as it was in 2008, while the monetary base is more than four times as big. What this tells us, in turn, is that most of the growth in the monetary base failed to translate to growth in money actually moving through the economy. Economists call this the “velocity of money” – the extent to which money created through monetary policy translates to real economic activity. What these figures tell us today is that, despite the Herculean efforts of the past seven years, monetary policy hit speedbumps and never got out of second gear to achieve its expected velocity.

Growth Is Still Growth

What does all this have to do with today’s job numbers? Mainly, it helps us understand the context in which inflation, wage growth and labor force participation have stayed muted for so long, despite all that hard work on the part of the Fed. Banks didn’t rush out to create lots of new loans with the fruits of their pumped-up reserve accounts because the demand wasn’t there – households were paying down debt and businesses were gun-shy about making new investments into productive assets. Those are the conditions a financial recession produces. The resulting behavior on the part of banks and households was rational and at least to some extent predictable.

This does not mean that we will never get back to normal conditions, though. Today’s growth remains below historical norms, but it is still growth. The payroll numbers released today did not show a decline in new jobs – just a smaller than expected increase. GDP, consumer confidence and other data points continue to move mostly in the right direction. We will see in the coming weeks whether problems elsewhere in the world show up in a larger way on our shores. For now we are not inclined to read too much doom and gloom into the picture. To answer the question posed earlier, we do not think this is as good as it gets.

At the same time, though, the rationale for Fed action in their desired 2015 time frame does not seem to be getting any stronger. We are increasingly of the opinion that less calendar-speak by FOMC members at their various conferences and confabs would be immensely helpful. Let the data speak, not the calendar.