The monthly jobs report came out this morning, telling us that U.S. nonfarm payrolls added 252,000 new able bodies to the workforce. Meanwhile the headline unemployment number dropped to 5.6%, the lowest since June 2008. This would appear to be good news, indicating that the growth narrative for the U.S. economy remains intact. But there are some soft spots lurking below the cheery headlines. Indeed, the net effect of today’s report may be to give the Fed further pause before moving ahead with a rate hike.

Money…That’s What I Want

What is missing from the jobs equation is wage growth. Average hourly earnings decreased slightly in December to $24.57/hour. For the year as a whole average wage growth more or less tracked inflation. Purchasing power on balance was neither lost nor gained. Weak wage growth indicates that there is still considerable slack in the economy, despite the headline growth signals. Employers appear to be under very little pressure to respond to wage demands, even with an unemployment rate 1.1% lower than it was one year ago. In the absence of upward pressure from rising wages it is difficult to see what could spark any significant inflationary pressures. Household budgets remain unchanged; families merely reallocate spending priorities (or use savings at the gas pump to pay down more debt) rather than increasing consumption. This, arguably, gives Chairwoman Yellen et al more room to hold off on rates should they feel the need to.

Maybe the Bond Market is Right, After All

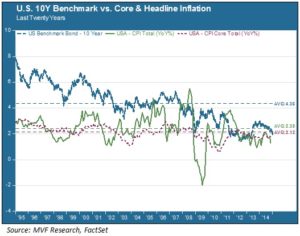

This muted-inflation environment seems to be what the bond market expects. Consider the current yield on the 10 year Treasury as compared to headline and core (ex-gas and groceries) inflation. The chart below shows the relationship between nominal yields and inflation over the past twenty years:

The narrow spread between yields and inflation suggests that the collective wisdom of the bond market, such as it may be, has a very dim view of growth prospects for at least the intermediate term. After all, if the incremental investor is willing to accept a nominal yield of 2% – about where the 10-year currently trades – that investor is apparently not losing sleep over loss of purchasing power. If you think the Fed funds rate will sit over 3% in several years’ time then it makes little sense to hold a long-dated asset and clip 2% coupons every year. Of course this is all subject to change – one would expect to see yields spike northward in light of any new data confirming stronger growth. But for now that catalyst has not manifested – and today’s jobs report is likely to do little to change that perception. Indeed, the 10 year yield has subsided yet again in the immediate wake of the jobs report.

PPR: Productivity and Participation Rate

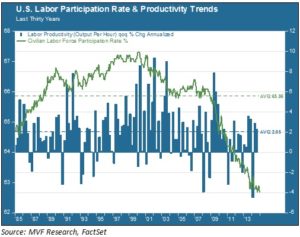

Growth comes about in two ways: from a growing population with a steady or increasing percentage of labor force participation, or from productivity (more goods and services produced per capita). But another data point in today’s jobs report reaffirms the disquieting trend of decreasing labor force participation. The participation rate for December was 62.7%, its lowest level in past thirty years. The chart below plots labor force participation against productivity (output per hour) over this time period.

There are a variety of explanations for the decreased participation, from discouraged workers to a higher number of retirees. It’s not all about retiring boomers, though – as Michael McDonough tweeted this morning, the labor participation rate for the 65 and over contingent has actually increased slightly over the past decade (purple line on the chart). We at least want to see this trend stabilize before getting too excited about growth prospects.

The productivity story is not all bad – after all, low growth in wages translates to lower unit labor costs, which translates to higher productivity. Looking ahead, though, we should hope that these successive waves of “disruptive efficiencies” touted by Silicon Valley wags really help boost increased output of goods and services.