Weaker than expected employment data is the main item on today’s macroeconomic menu. August payrolls fell below the closely-watched 200,000 number for the first time since January; at 142,000, the payroll numbers stand in sharp contrast to recent GDP, manufacturing, consumer confidence and other data points suggesting a steady, if not necessarily barnstorming, economic recovery.

In the short term, risk asset markets may welcome a muted jobs picture as putting a stay on the Fed’s timetable for raising interest rates. But as usual the real story is deeper in the details, away from the statistical vicissitudes of a single monthly reading. The labor force participation rate continues to decline, and this decline presents concerns about the prospects for healthy long-term economic growth.

The Second Wave

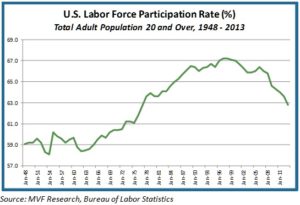

There have been two major paradigm shifts in the U.S. jobs market since the end of the Second World War. The first was the acceleration of entry into the workplace by women, a trend which gained steam in the 1960s and reached a peak in the late 1990s. This trend explains to a very large extent the dramatic rise in the postwar civilian labor force participation rate, as seen in the chart below.

This chart also provides a clue about the second wave in employment trends, namely the beginning of a decline in the participation rate for both men and women. The current level of 62.8% is the lowest participation rate since the 1970s. The chart shows that there was a brief uptick from 2003 to 2007, in concert with the cyclical recovery following the 2001-03 recession. But in the post-2008 recovery we see, not only the lack of any uptick, but a pronounced acceleration of the decline. Simply put: fewer adult Americans are working today, as a percentage of the total adult population, than at any time in more than 35 years.

No Easy Narratives

There is a dominant narrative in the financial media about what is driving the participation rate decline: it boils down to the two words “jobless recovery”. Increasingly, though, that easy explanation seems at odds with other employment data. For example, today’s report not only served up a resumed downtick of the headline unemployment rate to 6.1% — from the 2009 high of 10% — but also a decline in the number of long-term unemployed (out of work for six months or more), which fell by 192,000. There were also fewer Americans wanting full-time work but only working part time. And year-on-year wage growth is 2.1% – not a windfall, but outpacing inflation. “People are opting out because there are no jobs” doesn’t seem to be the full answer.

It also doesn’t have anything to do with arcane classifications about who is and is not considered a member of the labor force. You’re in the labor force – at least according to the Bureau of Labor Statistics – if you have a salaried job, a part-time job, a few freelance gigs or even if you are unemployed but looking for work. To be considered a job seeker by the BLS literally means having put out a resume or phone call, or even asking a friend about a work opportunity, at least once in the last 30 days. If you’re in that 37.2% of the adult population not participating in the labor force, you really are taking no action at all to look for work.

Work and Growth

Whatever the reasons, a continuation of this opt-out trend poses some serious questions for long term growth. The growth equation in a capitalist economy has always been fairly straightforward: businesses produce things people need and want, they hire people to produce those things, and people spend the money they earn on the same things. The virtuous cycle periodically reverses when the economy overheats and lending tightens, but the long term structural trend is ever-upward. If fewer people choose to opt into this system it cannot grow at the same pace, or perhaps at all.

Those are long term concerns that are unlikely to have much impact on what asset markets do today or in the final fiscal quarter of 2014. But they are concerns that hang over the economy like a cloud – hard to define, but notably gray. The relationship between labor and capital has always been dynamic – but both components have always been necessary for growth. They still are, until people figure out how to live and survive without working.