The narrative has been the same for the past five years: Europe as the global economy’s new sick person. The ill-fated single currency union, goes the narrative, has joined Japan as the ageing, no-growth patient being kept alive on life support and the jawboning feats of Dr. “Whatever It Takes” Draghi. Divergence is the new normal, with the U.S. economy regaining its growth mojo while the Old Continent slowly sinks into senescence and irrelevance. But narratives don’t last forever, and a few recent data points suggest that this one may be due for a change.

Greece Is Not the Word

The headlines coming out of Europe this week have largely been about the high-stakes negotiations between Greece and its EU policy partners over the terms of extending the financial assistance to the troubled nation which runs out at the end of this month. The story has had plenty of drama, not to mention a bevy of telegenic Hellenic ministers. But the Greek refinancing outcome is likelier than not to be a non-event. Negotiators will probably find a way to do what they do best – defer the final reckoning to another day. Even a so-called “Grexit”, where Greece leaves the single-currency union, would potentially have relatively mild repercussions outside the country’s own borders. Germany’s tough stance in the current negotiations belies a mood of serenity should that be the result.

The Purchasing Managers Speak

No, the interesting news in Europe this week comes in the rather bland form of a monthly reading of the Eurozone Purchasing Managers Index. The PMI serves as a proxy for the pace of business activity in both the manufacturing and the services sectors. A reading over 50 indicates expansion, while a number below that threshold suggests that business activity is contracting. The reading this month came in at 53.5, a solid uptick from the previous month and the third month in a row of gains. According to Markit, the publisher of the Eurozone PMI, the pace of activity indicates that Eurozone real GDP is likely to grow at approximately 0.3% for the quarter, or an annualized rate of 1.2%. That may not sound like much, but for an economy that has mostly seemed to be on the brink of falling back into recession, it is manna from heaven.

Riding the Currency Tailwinds

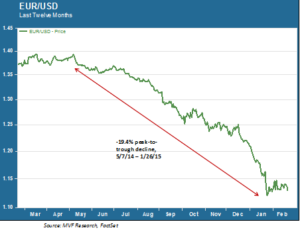

These recent economic readings align with a potential narrative we at MV Financial floated in our annual market outlook last month; the recent dramatic fall in the euro could be a catalyst for regional growth, at least in the short term, by making Eurozone exports more competitive. Indeed, the two big winners in the PMI report are Germany and France, who also happen to be the continent’s largest value-added exporters. This suggests that the euro’s 19.4% peak to trough decline (52 weeks), illustrated in the chart below, may be starting to show up on corporate balance sheets.

Make no mistake, it’s not all roses and honey for the Eurozone. The region still suffers under double digit unemployment and listless wage and price trends. Policymaking organs suffer from structural inefficiencies seemingly designed to ensure gridlock. Another recession is not inconceivable. But the recent numbers are at least a move in the right direction. The ECB’s forthcoming quantitative easing program may provide a further tailwind. Greece or no Greece, this year could mark a positive turn in Europe’s economic fortunes. That in turn would be good news for markets elsewhere.