So here we are again, nearing one of those seminal milestones in stock market lore. The Dow Jones Industrial Average, comprised of thirty (mostly household name-y) large-cap stocks, is an index whose main claim to fame is that its life span as a barometer of market sentiment extends all the way back to 1896. The Dow is poised to break through 20,000, a number whose main claim to fame is that it contains four zeroes. “Dow 20,000” screamed the entire front cover of Barron’s magazine last week. At the round earth’s imagined corners, blow your trumpets angels!

For portfolio analysts toiling away in the data-dense world of relative value movements, 250-day rolling returns and the like, these periodic “magic number moments” are scarcely worth a second look. That is particularly true when the index in question is the Dow, a much less useful or significant gauge than, say, the S&P 500 or the Russell 3000. Rationally speaking, there is nothing whatsoever of importance in these periodic episodes.

But rationality only counts for so much. In the vulgate of the wider population of investors and kibitzers, “the Dow” and “the market” are virtually interchangeable, and a nice round number like 20,000 has all the cultural significance of a special calendar date like January 1 or July 4. As with much else in the market, perception often becomes reality. Indexes do exhibit somewhat distinct trading patterns around these magic number moments, however silly it may seem. Thus, attention shall be paid.

Uncage the Elephant

The present magic number moment happens to coincide with a period of animal spirits stampeding up and down Wall Street. The Dow is up nine percent since the post-election rally kicked off on November 9. While the index has not actually broken through the threshold as we write this, it is entirely plausible that it will be on the other side by the time we publish. Given the momentum that continues to feed off itself, counterfactuals be damned, it is more likely than not that the melt-up will carry stocks through to year-end. What then? Inquiring minds will want to know.

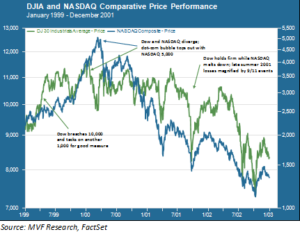

We have no crystal ball, of course, but we can supply a bit of historical perspective. As it turns out, the last time the Dow reached a four-zero magic moment, we were also in the middle of a market melt-up. Consider the chart below.

This chart tracks the performance of the Dow – with the tech-heavy NASDAQ shown for comparison – during the last gasp of the late-1990s tech bubble and the ensuing bear market. As the chart shows, the Dow (green line and left-hand y axis) broke through the magic number of 10,000 in late March of 1999. Dow 10,000! These round numbers often act as very tough resistance levels, but 1999’s animal spirits pushed through the barrier with relative ease and, for good measure, surged an additional 1,000 points before settling into a brief holding pattern.

Forks in the Road

One interesting feature of this end-game stage of the late-90s melt-up is the pronounced divergence between the Dow and the NASDAQ on several occasions. This observation may have some relevance in thinking about today’s environment. The last gasp of the tech bubble, when investors more or less indiscriminately bought anything that sounded tech-y and Internet-y regardless of valuation or other counterfactuals, started in late summer 1999 and topped out in March 2000. The NASDAQ, as a proxy for the tech rally, enjoyed about seven months of near-unidirectional upward momentum during this melt-up.

The Dow, conversely, fell more than 11 percent from August to October 1999, and experienced another, even more pronounced correction of minus 16 percent from January 17 to March 7, 2000. The trough for this Dow pullback, then, roughly coincided with the NASDAQ’s March 10 bubble peak of 5,048. And, in fact, the Dow proceeded to bounce up by 15 percent from March 14 to April 11, during which time the wheels came off the dot-coms and NASDAQ experienced the first of what would be a series of bone-jarring descents over the next twelve months.

Mass Movements Then…

Why did the Dow diverge so far away from the NASDAQ (and, to a somewhat lesser extent, from the S&P 500) over that last leg of the 1999-2000 melt-up, and what light may that shed on market movements in today’s environment?

The driving narrative of that late-era ‘90s rally was technology. Investors were less concerned about what individual stocks they owned, and more concerned about getting in on the general action. The ability to obtain broad exposure to the tech and Internet sector – either through one of the then-small number of nascent ETFs, a passive index fund or similar pooled vehicle structure – was more important than the relative merits of any given stock.

By contrast to the tech-dominated NASDAQ, the Dow had a relative scarcity of tech names; only IBM, in fact, at the beginning of 1999, with Intel and Microsoft somewhat latterly tossed into the mix in November of that year. The Dow’s pullbacks in late 1999 and early 2000 thus had almost nothing in common with prevailing attitudes about the tech sector, and plausibly much more to do with valuation-wary investors looking for ways to pare back equity holdings without risking their clients’ ire by dumping those beloved shares of Cisco and Pets.com.

…Mass Movements Now

This year’s post-November 8 environment is likewise largely driven by a couple top-down themes. This time, the blessings of the narrative have fallen disproportionately on a couple sectors, in particular financials, but so far the broad indexes continue to move fairly closely in lockstep.

The mass movement vehicle of choice today is the exchange traded fund. ETFs offer exposure to just about any equity or fixed income asset class, including all the major broad indexes. Complex (and not so complex) algorithms employ ETFs for quick and efficient exposure to thematic narratives, such as the reflation-infrastructure trade that has been dominant since November.

But not all indexes attract the same level of interest from the short-term money. Consider that the average daily trading volume of SPY, the SPDR S&P 500 ETF, is about 94 million shares. For XLF, SPDR’s financial sector offering, average daily volume is about 80 million shares, and for QQQ, the PowerShares NASDAQ 100 vehicle, it is a still-respectable 24 million shares.

How Now, Dow?

By contrast, the average daily volume for DIA, the BlackRock iShares ETF for the Dow Jones Industrial Average, is just around 3 million shares – less than five percent of the volume for SPY. This statistic underscores one of our opening observations in this paper: as much as the average investor equates “the Dow” with “the market,” professional investors have little use for this quaint artifact of U.S. stock market history. Since the Dow is really not a ready proxy for either a specific asset class or a wider market gauge, it doesn’t offer much of a compelling reason for use in those algorithm-driven strategies that dominate short-term trading volume.

Which, in turn, may make it worth keeping an eye on the Dow once that magic number moment of 20,000 has receded into the rear view mirror. If those thirty stocks diverge away from their broad index cousins – S&P, Russell, NASDAQ et al – they may again be the canary in the coal mine warning that the fundamentals are out of line with the still-giddy prevailing market narrative. Of course, there is no assurance that this scenario will play out, and we would advise against hanging one’s hat on this outcome. Good investing is about paying attention to lots of moving parts while maintaining the discipline not to rely unduly on one or two. But we will be keeping track of the Dow’s fortunes in the coming weeks, even after the Dow 20,000! hoopla has come and gone.