The headline for this week’s article may be just a bit misleading: “making sense of a strange week” is actually something we find ourselves trying to do more often than not as the calendar progresses through the year. But a few of the high-profile events of this week are instructive as they relate to themes that show up frequently in these pages. On the economic front we had a couple big inflation numbers that got the market’s full attention. In the Middle East we are once again witnessing a descent into all-out war between Israel and the Palestinians, reminding us of the fragile state of global geopolitics even as human misery rarely shows up on the radar screen of things that move markets.

Yesterday the Center for Disease Control did an abrupt about-face from its previous guidance of several weeks earlier and declared that fully vaccinated Americans can basically get back to their lives without needing to mask up. That is welcome news for those of us who have taken advantage of the opportunity to get the vaccine – but also a bit perplexing given the extreme caution of the CDC’s earlier guidance. How strange – it’s almost like some very prominent person saying one day that bitcoin is the absolute coolest thing in the world, and the next day crying shame! – and refusing to accept the cryptocurrency as payment for electric-powered vehicles due to its eco-unfriendliness. Oh wait…that happened this week as well.

Oh, and did we mention gas lines? Just in case those inflation numbers were not enough of a 1970s vibe for you, a cyberattack on a crucial fuel pipeline basically shut down supplies of petroleum products to East Coast retail outlets. Those same people who stockpiled hundreds of rolls of toilet paper a year ago were out this week with their red cans hoarding whatever gas they could get their little hands on. Groovy.

Here Comes the Inflation

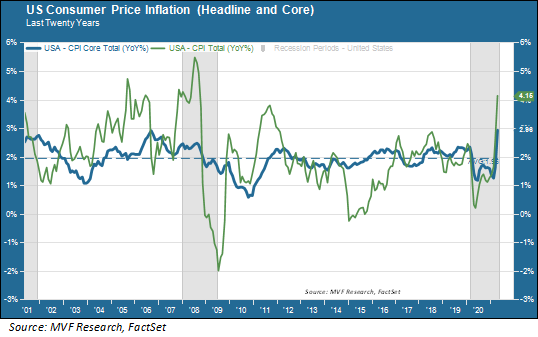

A few weeks ago we noted that upcoming inflation figures are likely to be very different from recent trends, while cautioning against reading too much into the numbers. Well here we are with the first batch.

Core inflation – the less-volatile blue trendline that excludes food and energy prices – is higher at 2.96 percent than it has been at any time in the last twenty years. Now, as we have observed before, that number is expressed on a year-on-year basis, meaning the point of comparison was April 2020 when many prices were briefly and unrealistically low in the immediate wake of the pandemic lockdown. Nonetheless the result was higher than economists expected, and the sequential monthly rise of 0.9 percent was also above the 0.3 percent consensus expectation.

The CPI release on Wednesday did have a knock-down effect on stock prices, probably due mostly to their being higher than the forecasts. But the numbers did little to change the nature of the debate, with the Fed on the one hand maintaining confidence that inflation can run hotter than expected for a few months without any longer-term damage, and the bond market saying on the other that the Fed is behind the curve and will be forced to retreat from easy money sooner than expected. For its part the market seems to be relatively indifferent. Stock prices bounced back on Thursday and continued to rally through early trading today. The bond market also appears to be unfazed for now with the 10-year Treasury yield holding steady below 1.65 percent.

The Indifference Curve

“Indifference” indeed might be the one word that best sums up the current state of trends in the markets. At this point the default assumption seems to be that no matter how many strange things happen in the course of a week – no matter how many times ordinary people remark “never seen that before” as they go about their lives – the market just shrugs its figurative shoulders and says “meh.” This complacency seems to be rooted in a conviction (and by this time a quite rational conviction) that whatever happens in the world, the Fed will always be there with a checkbook to bail out sinking prices. “But the Fed” is the go-to reply to just about anything, perhaps followed by “remember 3/23” in honor of the day when the Fed’s offer to buy just about any kind of bond out there ended the pandemic panic and ignited one of the most breathless rallies ever to take place.

Don’t fight the Fed, say the wise veterans of financial markets, and that is sound advice. Another piece of good advice, though, is to remind oneself that nothing lasts forever. Things don’t matter until they do matter. Perhaps this week’s cyberattack on Colonial Pipeline didn’t much matter because, well, the market figured they would pay the ransom and get on with things, which is indeed what happened. But cyberterrorism is one of the defining risks of our age, and on one day it will matter. Maybe war in the Middle East is just geopolitics as usual, so no big deal. But war in Taiwan – very much a “known unknown” type of threat – would have the potential to completely upend global supply chains in a way that even the pandemic could not achieve. One day that, too, may matter.

That’s why we do spend all this time trying to make sense of weird weeks like this one, even if Mr. Market just grins, shrugs his shoulders and texts LOL to us. Because it won’t matter, until it does.